Why the Goldback Premium is Worth It: A Comparison to Fiat and Alternative Currencies.

The Goldback, a spendable currency made with 24-karat gold, carries a premium over its raw gold content. Critics may question this premium, but when compared to fiat paper money and other alternative currencies, the Goldback’s unique advantages make it a superior option for those seeking sound money. Here’s why:

1. Intrinsic Value vs. Fiat Money

Fiat currencies, like the U.S. dollar, have no intrinsic value—they are backed solely by government decree and trust. This makes them vulnerable to:

• Inflation: Fiat money consistently loses purchasing power as central banks print more to fund deficits or stimulate the economy.

• Devaluation: Currency devaluation erodes wealth, especially during economic instability.

In contrast, Goldbacks are made with real gold, giving them intrinsic value that is not subject to the whims of monetary policy. Even with a premium, their value is anchored in a tangible asset that has maintained purchasing power for thousands of years.

2. Portability and Usability

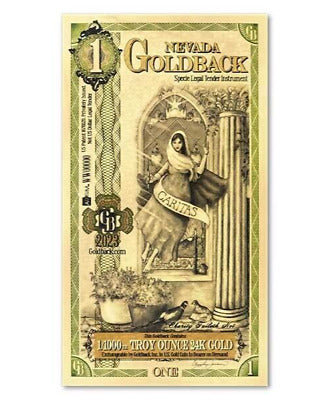

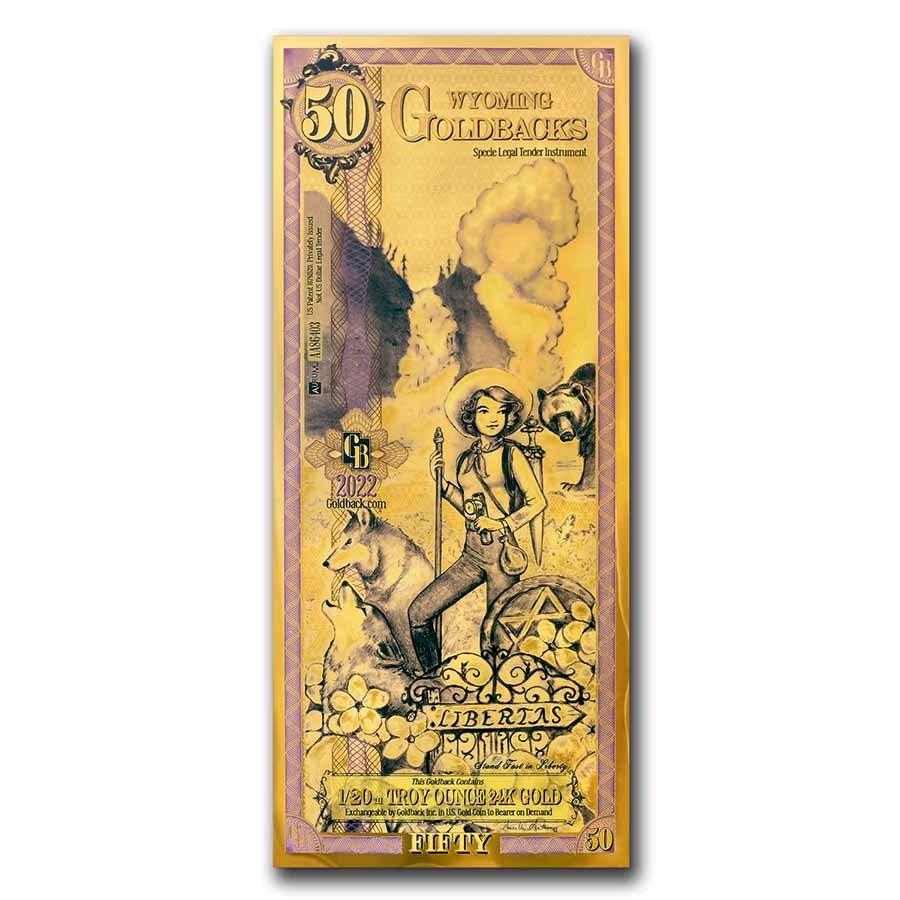

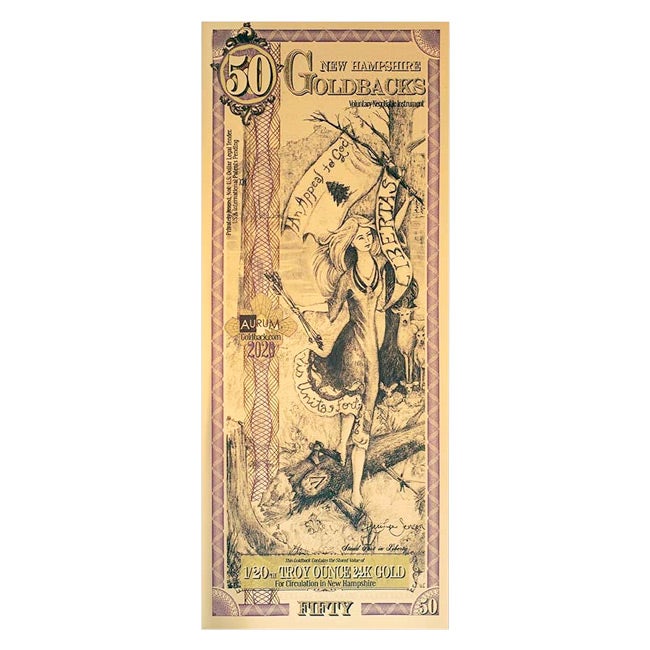

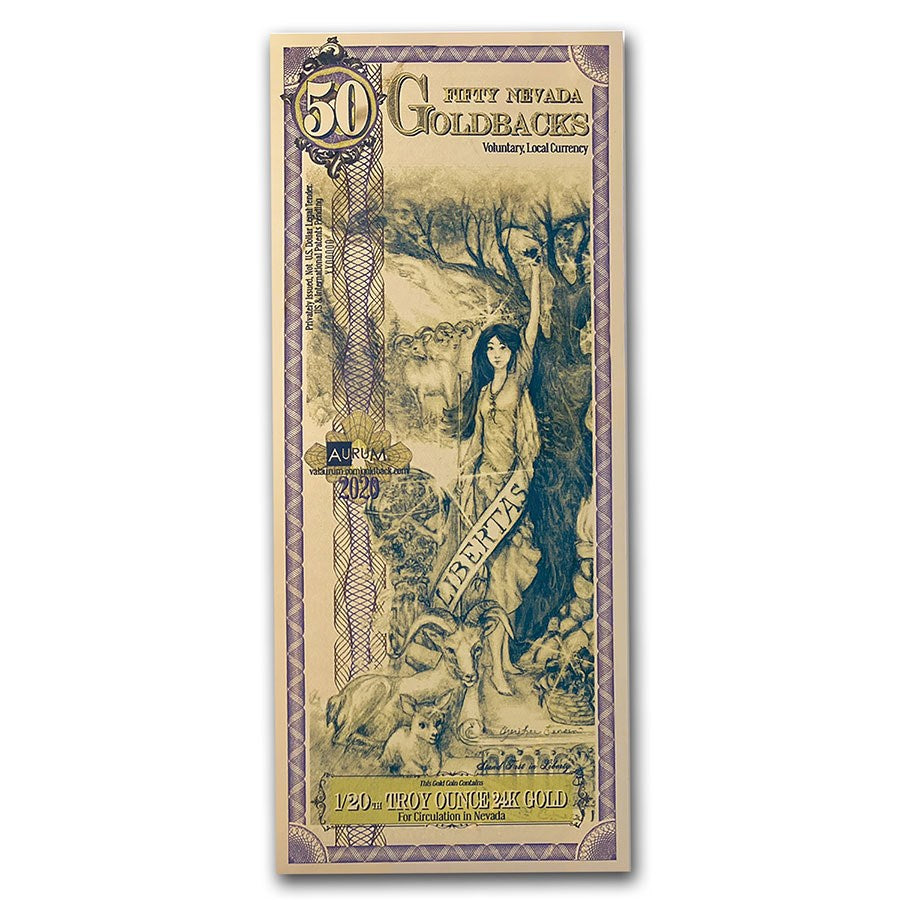

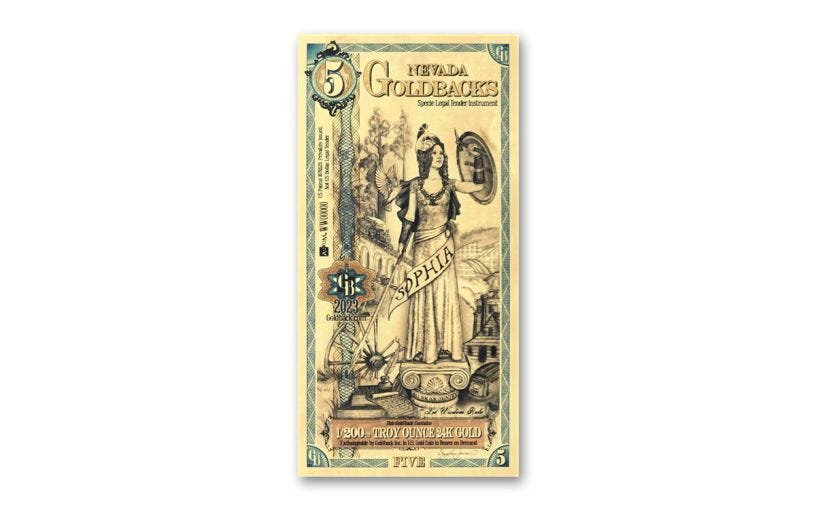

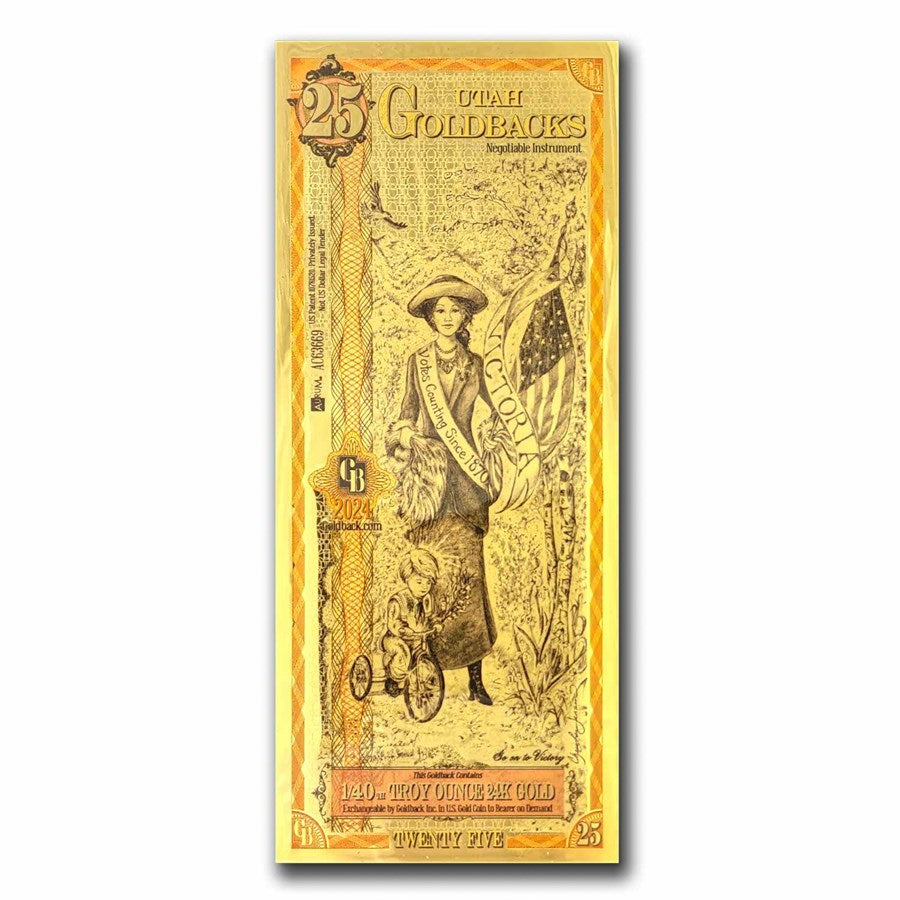

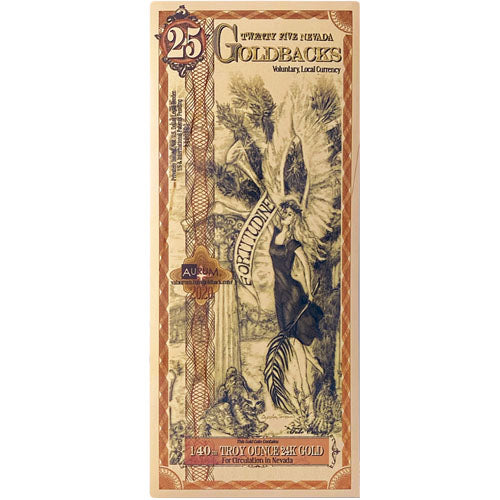

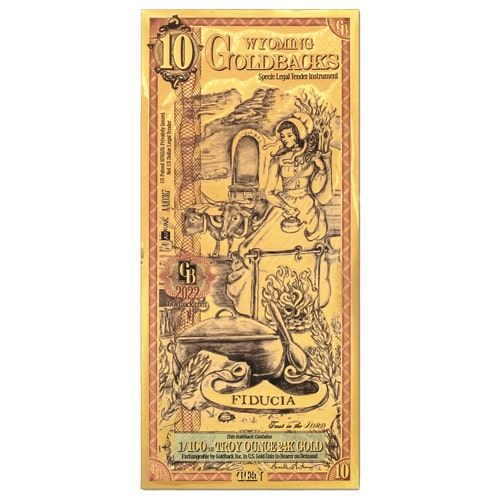

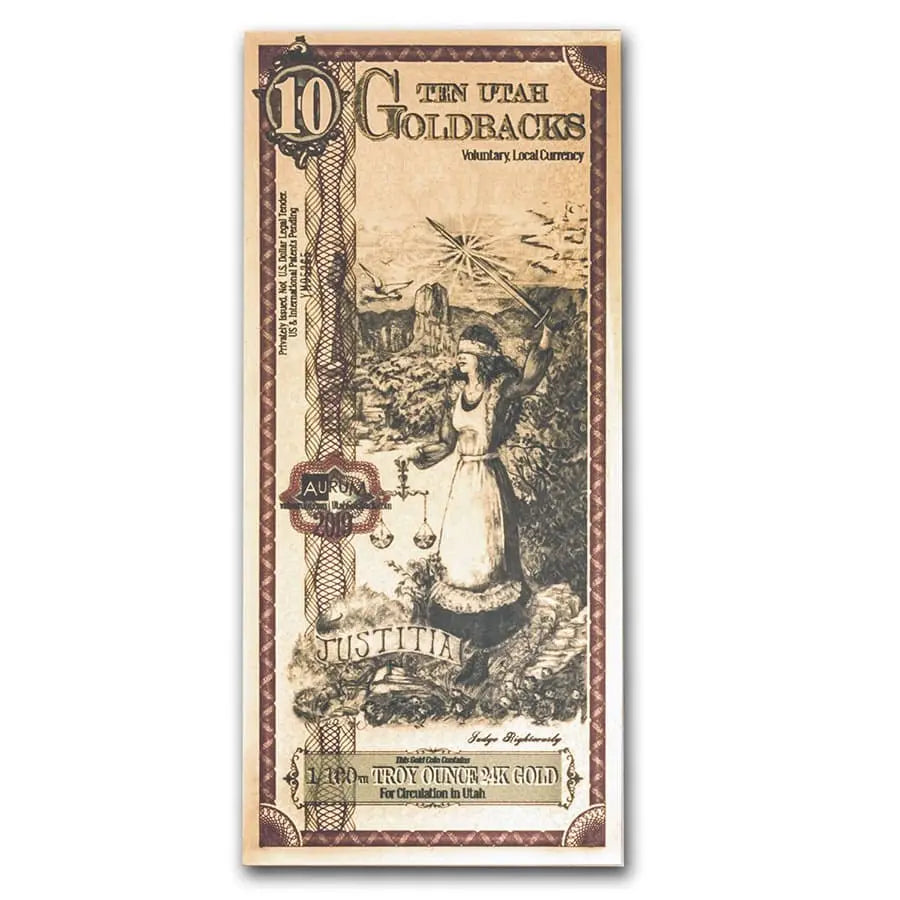

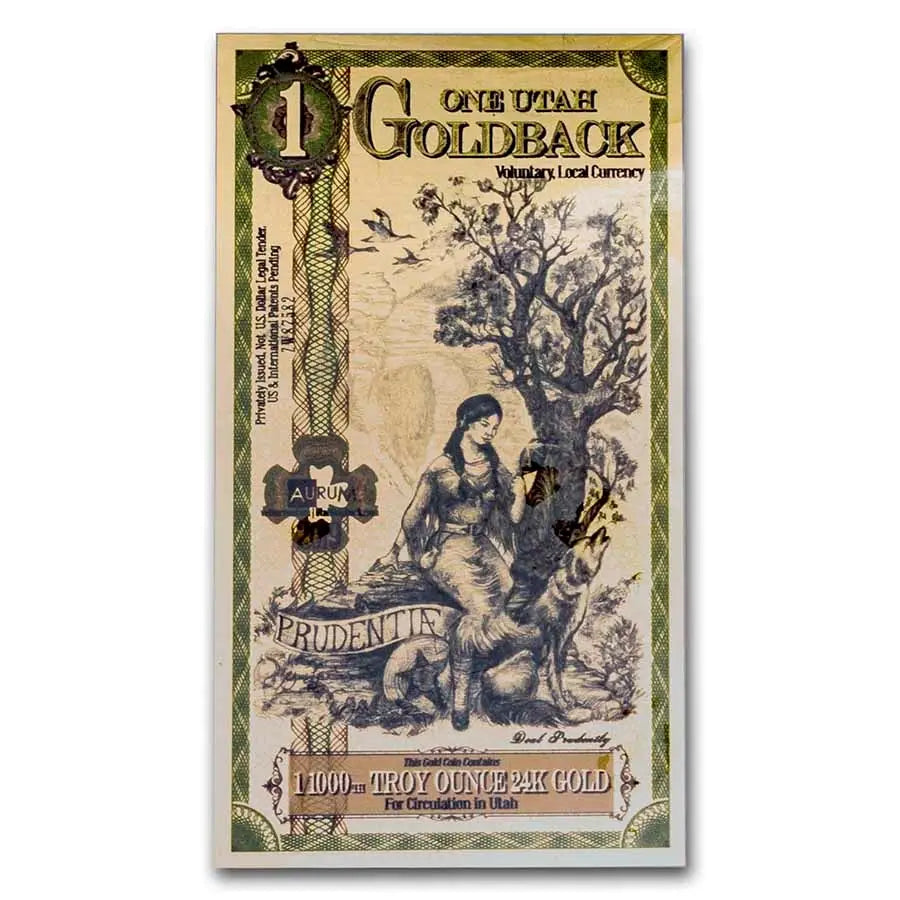

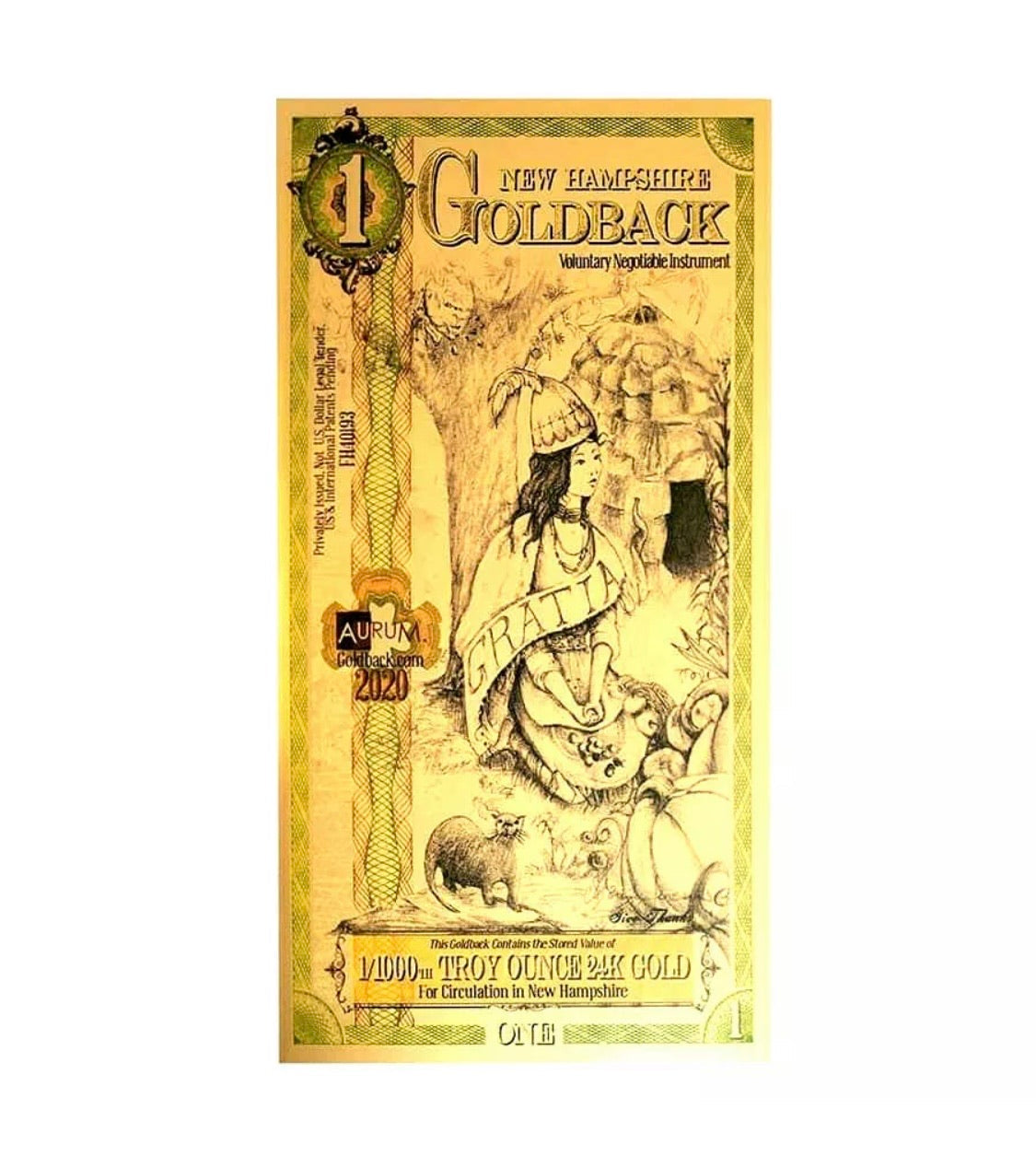

Goldbacks offer a practical way to use gold in everyday transactions, something traditional gold coins or bullion cannot provide. While gold coins are often too valuable for small purchases and lack divisibility, Goldbacks are available in denominations as small as 1/1000th of an ounce, making them ideal for:

• Small-scale transactions.

• Local trade with businesses that accept them.

This usability justifies the premium, as it bridges the gap between gold’s value and its practicality as money.

3. Durability and Design

Unlike fiat paper money, which wears out over time, Goldbacks are made using advanced technology that layers gold within a polymer substrate. This makes them:

• Durable: Resistant to wear and tear, ensuring longevity.

• Secure: Difficult to counterfeit due to their intricate design and embedded gold content.

The craftsmanship and security of Goldbacks contribute to their premium but also make them a reliable form of currency.

4. Inflation Resistance

Goldbacks are inherently inflation-resistant because their value is tied to gold, which has historically preserved purchasing power. In contrast:

• Fiat currencies lose value over time due to inflation.

• Many alternative currencies, like cryptocurrencies, are highly volatile and lack the stability gold provides.

The premium reflects not just the cost of production but also the peace of mind that comes with owning a stable, inflation-resistant currency.

5. Community and Adoption

Goldbacks are gaining traction in local economies as a medium of exchange. This adoption creates a network effect, where their utility increases as more people and businesses accept them. Unlike fiat money, which depends on central banks, or cryptocurrencies, which rely on digital infrastructure, Goldbacks are tangible and decentralized, fostering trust and resilience.

Conclusion: The Premium Reflects Value

The premium on Goldbacks is not a markup for profit but a reflection of their unique benefits: intrinsic value, usability, durability, and inflation resistance. Compared to fiat money, which erodes wealth, and alternative currencies, which may lack stability or practicality, Goldbacks stand out as a reliable, modern form of sound money.

For those who value financial security and the ability to transact in real money, the Goldback premium is a worthwhile investment.