Goldback vs Gold Bullion

A Goldback “gold-cash” is a form of currency made with thin layers of gold embedded in polymer notes, offer several advantages over traditional gold bullion beyond just being lighter and harder to imitate. Here’s a detailed look at why Goldbacks can be a better option for certain uses:

1. Divisibility

• Goldbacks: Goldbacks are designed in small, precise denominations (e.g., 1/1000th of an ounce of gold), making them highly divisible and practical for small transactions.

• Gold Bullion: Gold bullion is typically sold in larger weights (e.g., 1 ounce, 10 grams) and is not easily divisible without specialized equipment, making it less practical for everyday use or small trades.

2. Spendability

• Goldbacks: Goldbacks are designed as a form of currency, meaning they can be used directly for purchases in participating markets. Their denominations make them practical for barter or trade.

• Gold Bullion: Gold bullion is not typically used for direct transactions and would need to be converted to fiat currency or smaller forms to be spendable.

3. Durability

• Goldbacks: The polymer coating on Goldbacks protects the embedded gold, making them resistant to damage from handling, moisture, or wear.

• Gold Bullion: Gold is a soft metal and can be scratched or dented easily, which can affect its aesthetic and resale value.

4. Accessibility

• Goldbacks: Because they are available in small denominations, Goldbacks are accessible to individuals who might not be able to afford a full ounce or even a gram of gold bullion.

• Gold Bullion: The high cost of larger gold bars or coins can be prohibitive for small investors or those seeking to use gold for everyday purposes.

5. Portability

• Goldbacks: Goldbacks are lightweight, thin, and easy to carry in a wallet, making them highly portable.

• Gold Bullion: While bullion is portable in the sense of value density, its weight and bulk make it less convenient for carrying in small amounts.

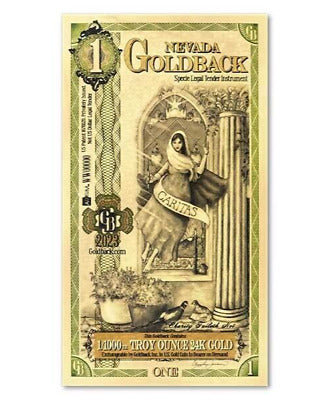

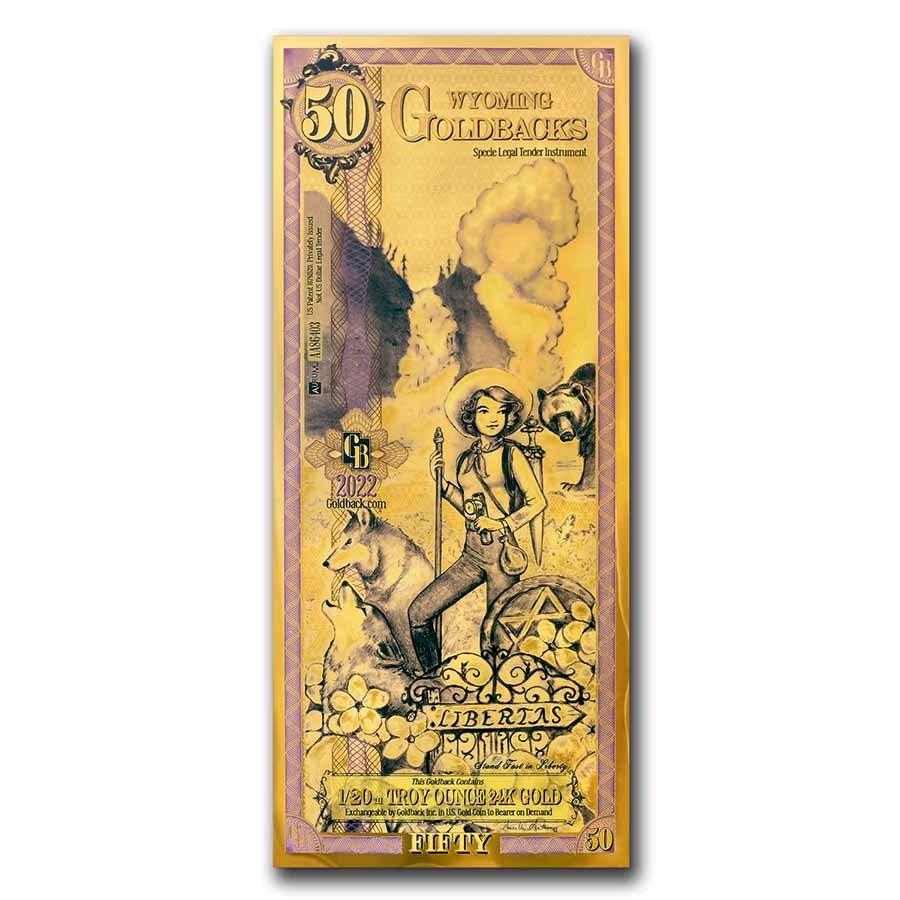

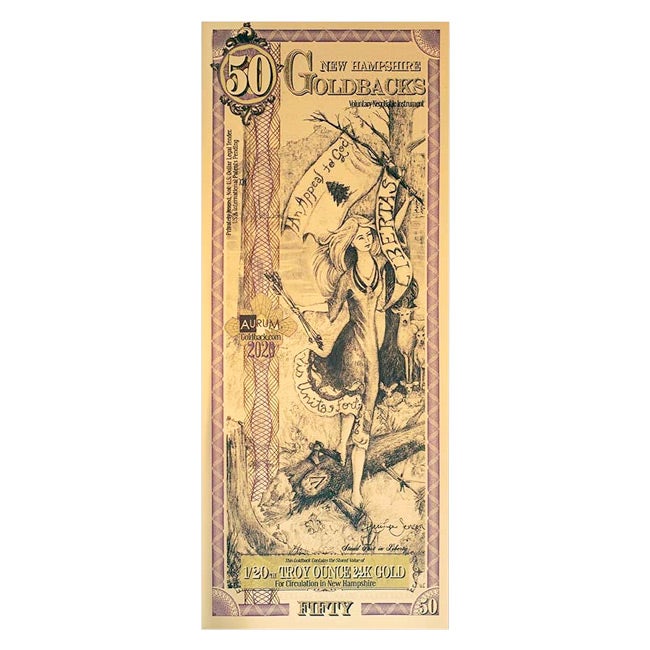

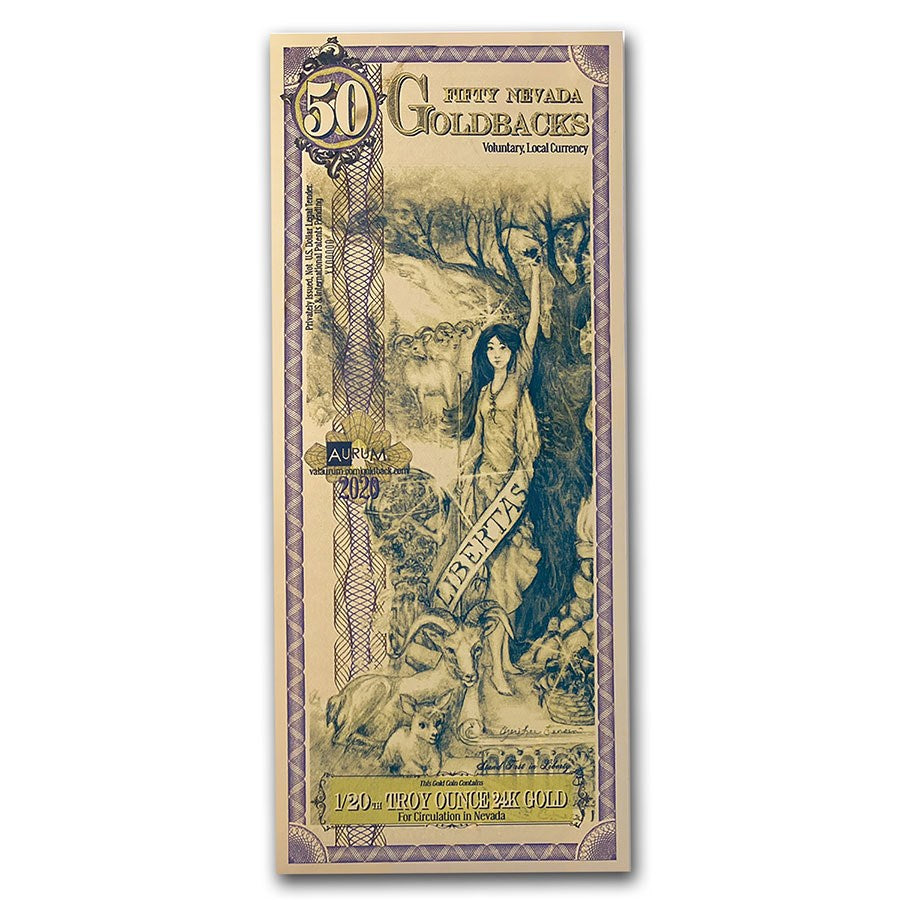

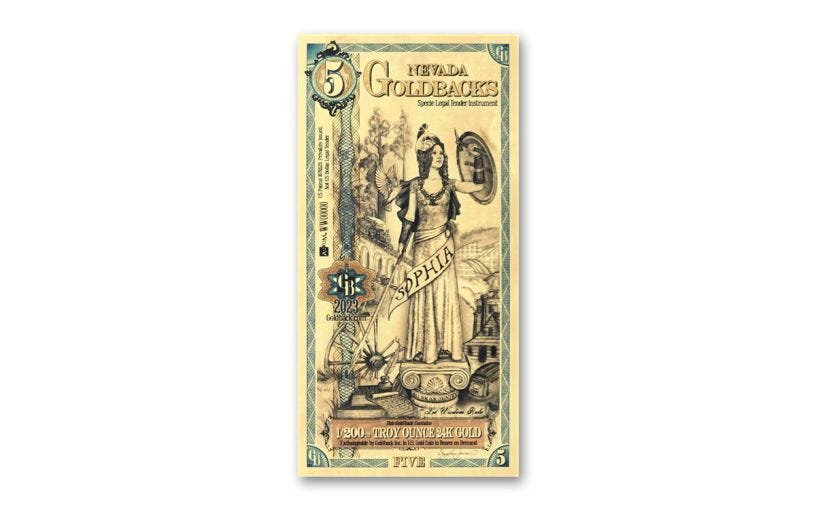

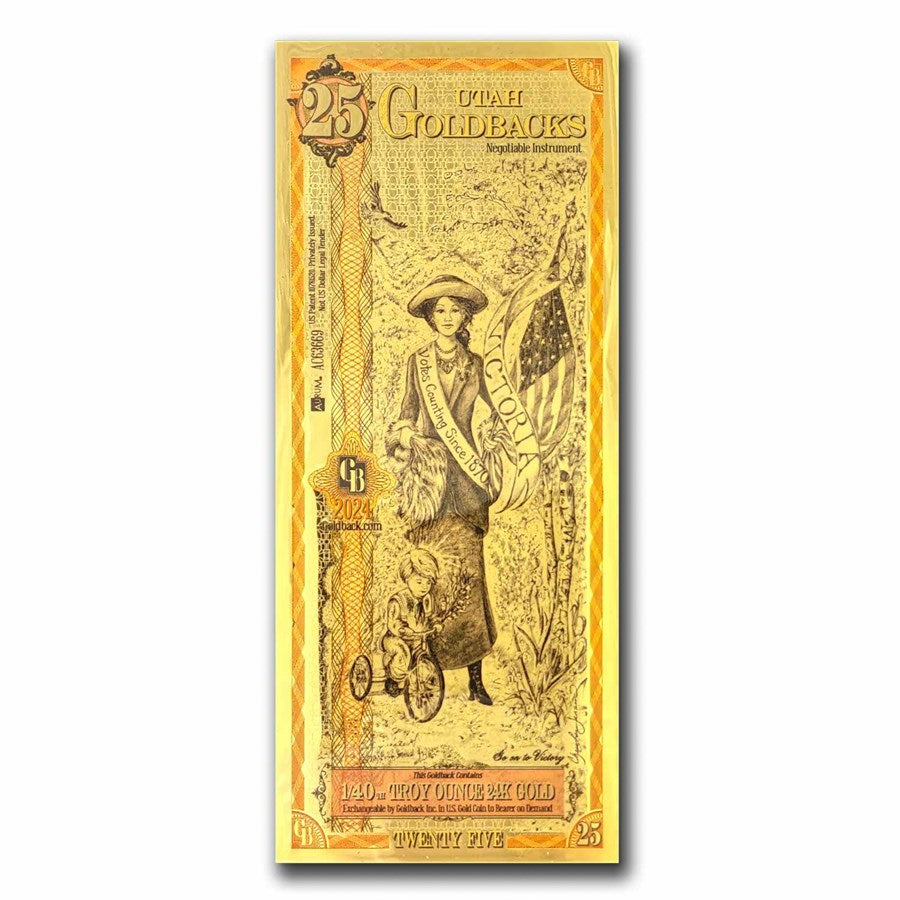

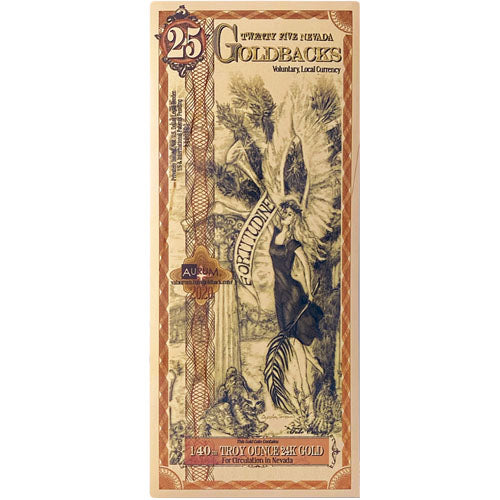

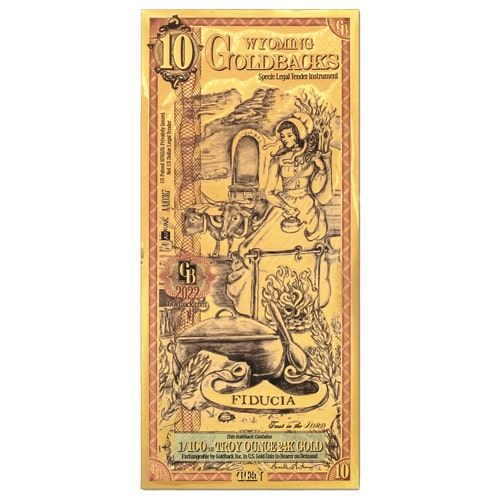

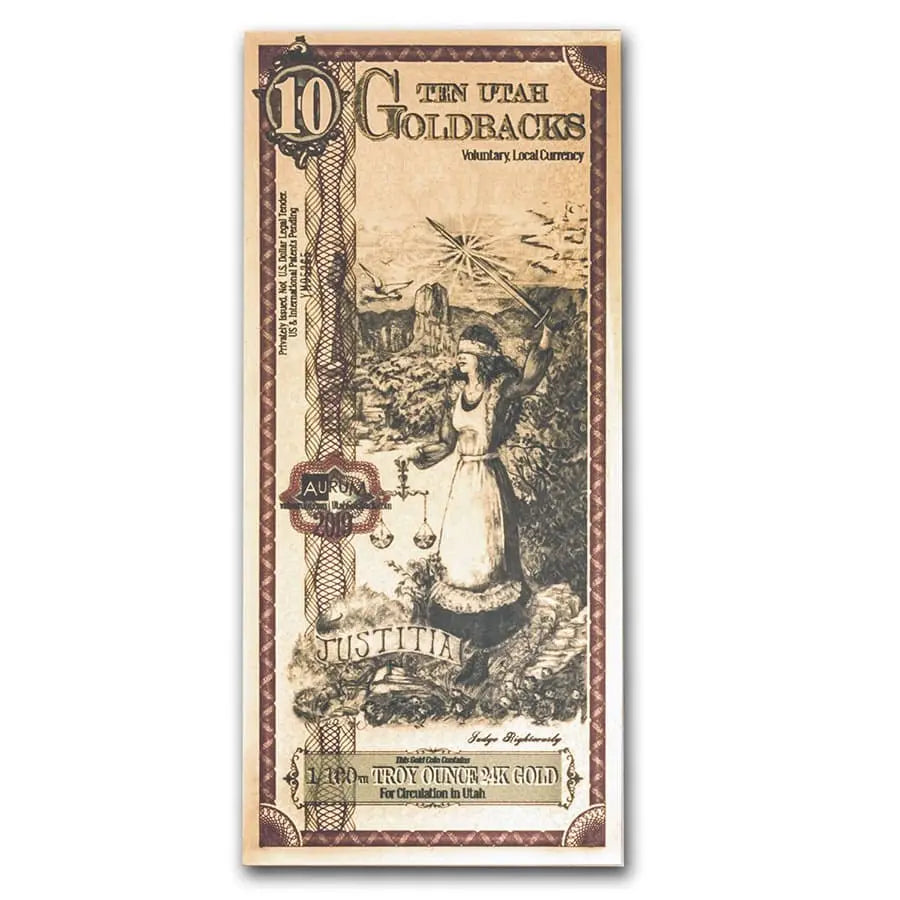

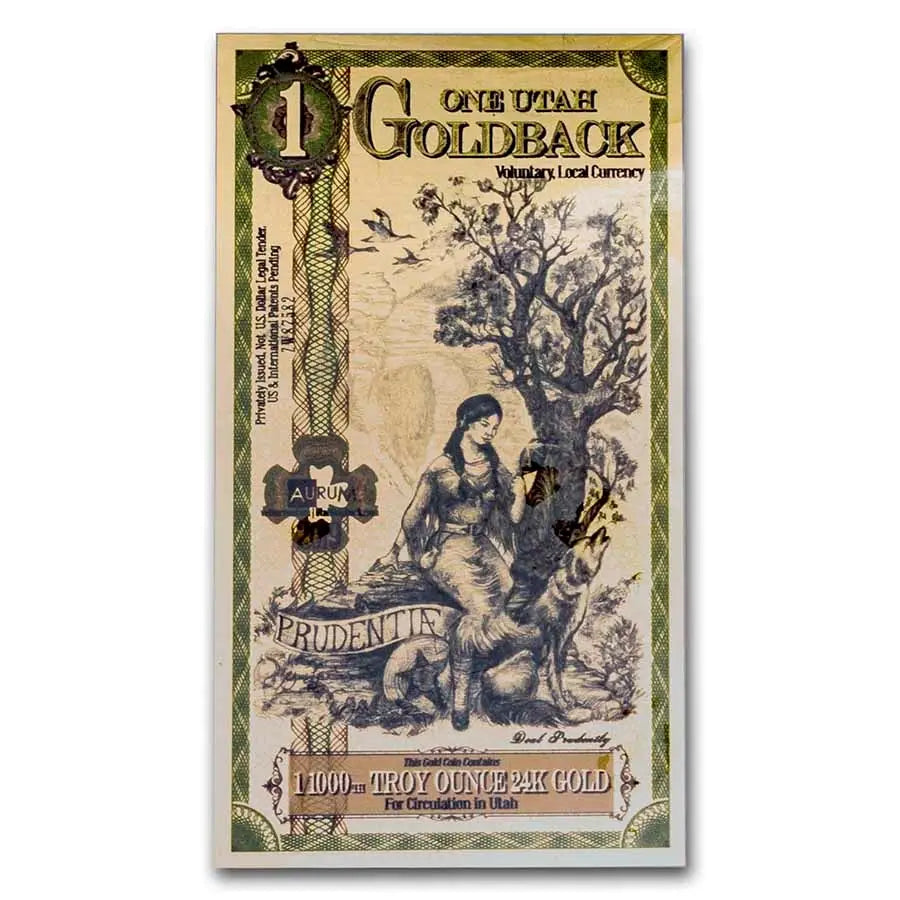

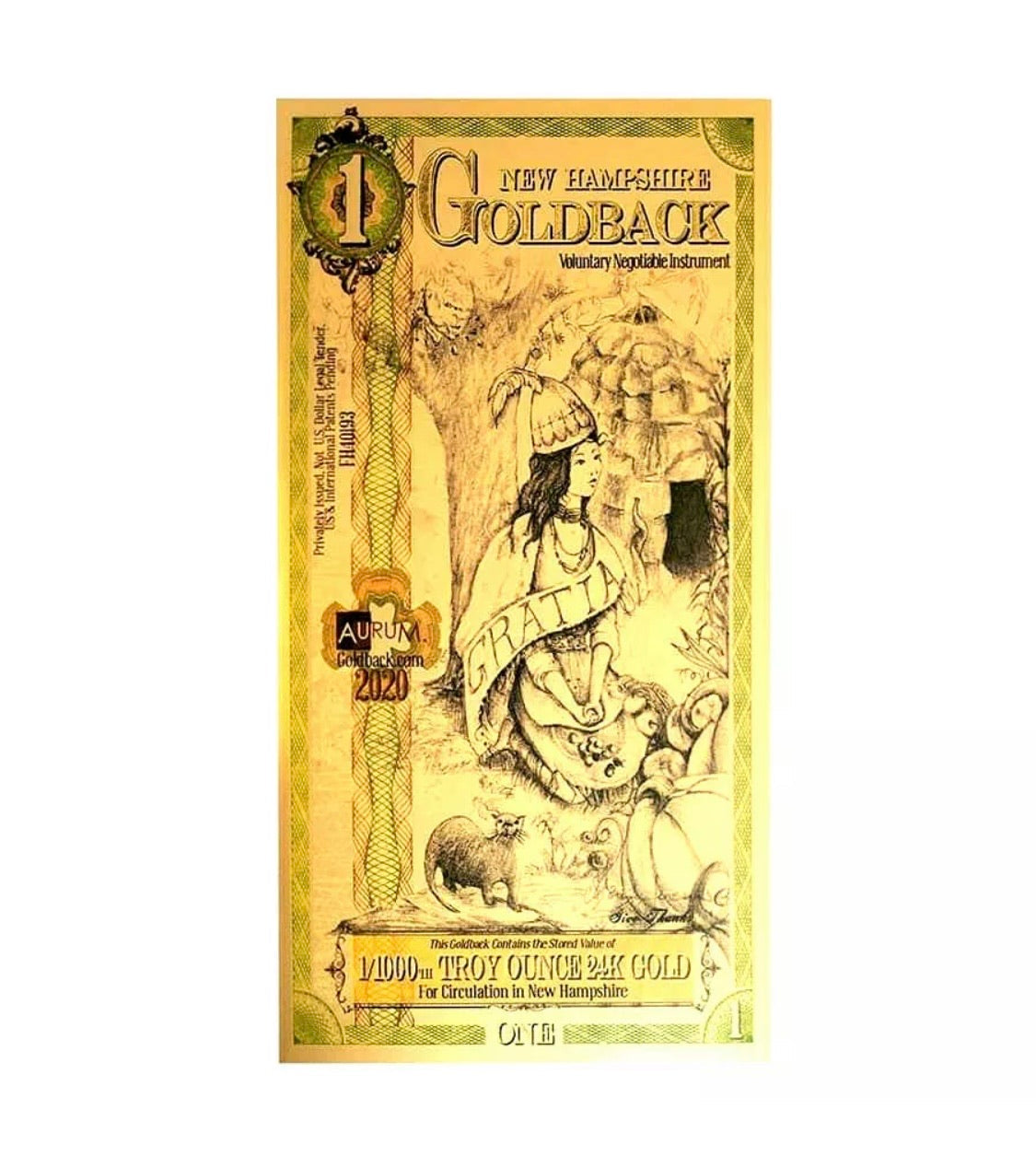

6. Aesthetic Appeal

• Goldbacks: Goldbacks are intricately designed with detailed artwork, enhancing their visual appeal and making them desirable for collectors.

• Gold Bullion: While bullion can be attractive, its designs are typically simpler and focus on standardization rather than artistic value.

7. Security and Authenticity

• Goldbacks: The unique manufacturing process of embedding gold in polymer and the detailed artwork make Goldbacks harder to counterfeit than traditional gold bullion.

• Gold Bullion: While reputable bullion comes with certifications, it is still susceptible to counterfeiting and requires testing for authenticity in some cases.

8. Local Economy Support

• Goldbacks: Many Goldbacks are designed for use within specific local economies, encouraging the use of sound money in daily transactions and supporting local businesses.

• Gold Bullion: Gold bullion is typically used as a store of value or investment and does not have the same direct impact on local commerce.

9. Fractional Reserve Alternative

• Goldbacks: They offer a tangible alternative to fiat currency, allowing people to hold and transact in gold without the need for banks or intermediaries.

• Gold Bullion: While bullion serves as a store of value, it is not as easily integrated into everyday financial systems.

10. Lower Entry Barrier for Everyday Use

• Goldbacks: By allowing people to transact in fractions of an ounce of gold, Goldbacks make the concept of sound money more accessible to the average person.

• Gold Bullion: Gold bullion, by contrast, is more suited for large-scale savings or investments and less practical for daily use.

Conclusion

Goldbacks offer a practical, durable, and accessible way to own and use gold, especially for small transactions or as a hedge against inflation. While gold bullion remains an excellent store of value for long-term investment, Goldbacks provide a unique and versatile solution for those who want to integrate gold into their everyday financial lives.