Gold was better for workers than paper fiat.

The divergence between workers’ productivity and wages after 1971, when President Richard Nixon removed the U.S. dollar from the gold standard, is a critical turning point in economic history. Here’s an explanation of why this happened and its broader implications:

Before 1971: The Gold Standard Era

1. Productivity and Wages Rose Together:

• Under the gold standard, the U.S. dollar was tied to a fixed amount of gold. This limited the ability of the government and central banks to print money indiscriminately.

• Economic growth during this period was relatively stable, and the monetary system ensured that productivity gains translated into higher wages for workers. Businesses, constrained by sound money principles, distributed profits more equitably between capital (owners) and labor (workers).

E2. Inflation Control:

• The gold standard acted as a natural check on inflation, preserving the purchasing power of wages over time. This ensured that workers benefited directly from the value they created.

After 1971: Fiat Money and Wage Stagnation

1. Decoupling of Productivity and Wages:

• After Nixon ended the gold standard, the U.S. transitioned to a fiat currency system. This gave the Federal Reserve and the government the ability to print money and expand the money supply without being constrained by gold reserves.

• While productivity (output per hour worked) continued to grow due to technological advancements and automation, wages for most workers stagnated. The benefits of increased productivity began to flow disproportionately to capital owners (investors and executives) rather than workers.

2. Inflation and Erosion of Purchasing Power:

• The removal of the gold standard led to periodic inflation, which eroded the real purchasing power of wages. While nominal wages may have increased slightly, they did not keep up with the rising cost of living.

3. Weaker Labor Unions:

• The 1970s and 1980s saw a decline in union membership and collective bargaining power. This weakened workers’ ability to demand higher wages that reflected their productivity.

4. Globalization and Outsourcing:

• The rise of globalization allowed companies to outsource labor to countries with lower wages, putting downward pressure on wages in developed economies like the U.S.

5. Financialization of the Economy:

• After 1971, there was a significant shift toward financial markets and speculative investments. Instead of reinvesting profits into higher wages or domestic production, corporations focused on stock buybacks, dividends, and executive compensation.

6. Income Inequality:

• The fiat money system contributed to growing wealth inequality. Asset prices (stocks, real estate) surged due to monetary expansion, benefiting those who owned capital while leaving wage earners behind.

Evidence of the Productivity-Wage Gap

Data from the Economic Policy Institute illustrates the growing gap:

• From 1948 to 1973, productivity and hourly compensation grew in tandem (productivity by 96.7%, wages by 91.3%).

• From 1973 to 2020, productivity rose by 73.2%, while hourly compensation increased by only 17.2%.

This divergence highlights how the economic system shifted to favor capital over labor after the gold standard was abandoned.

Implications of the Shift

1. Economic Inequality:

• The decoupling of wages and productivity has contributed to rising income and wealth inequality, as the majority of economic gains now go to the top 1% of earners.

2. Reduced Middle-Class Prosperity:

• Wage stagnation has made it harder for middle-class families to achieve financial security, leading to increased reliance on debt and government support.

3. Political and Social Tensions:

• Economic inequality has fueled political polarization and social unrest, as many workers feel left behind by the system.

Conclusion: A Systemic Challenge

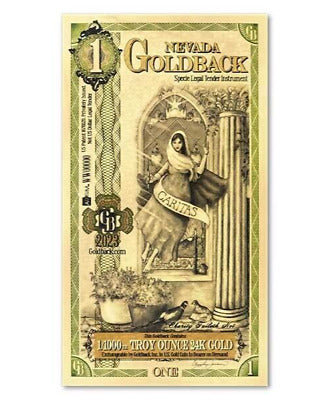

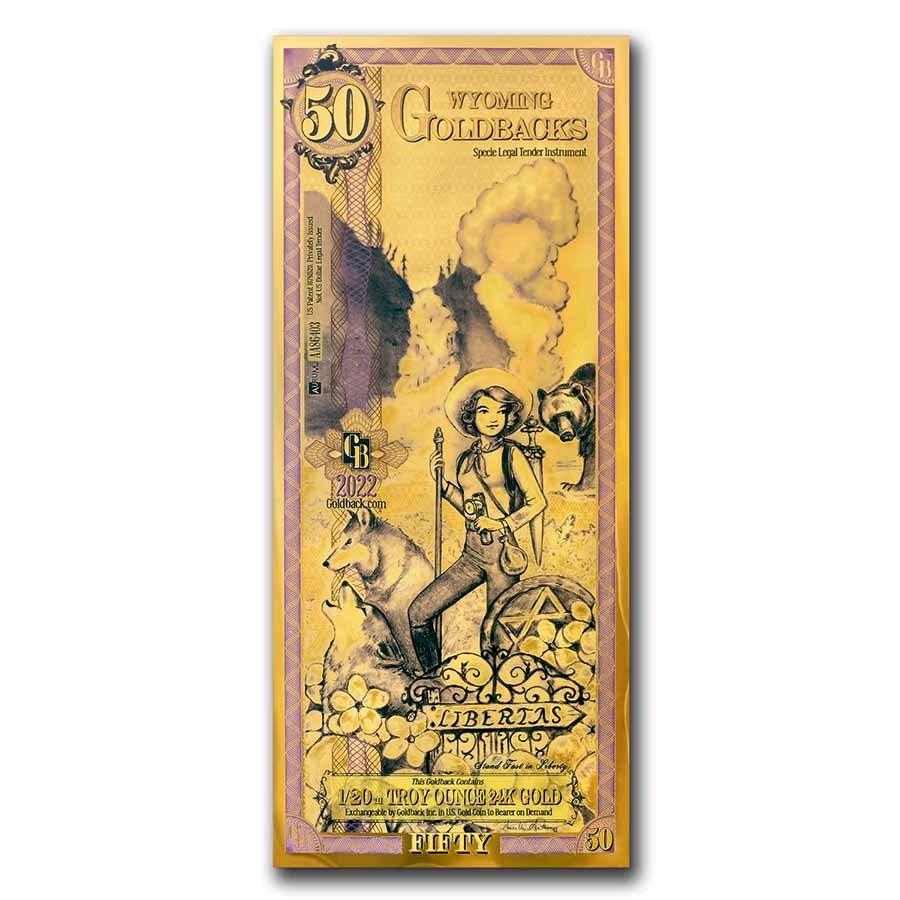

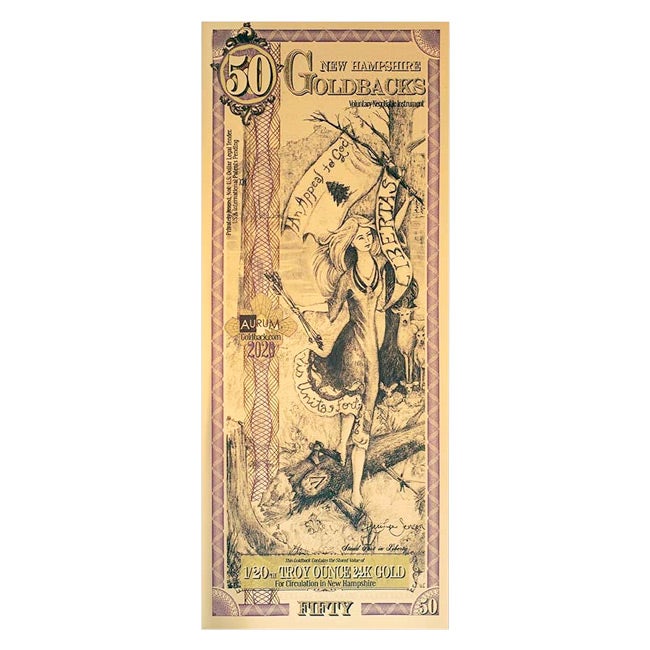

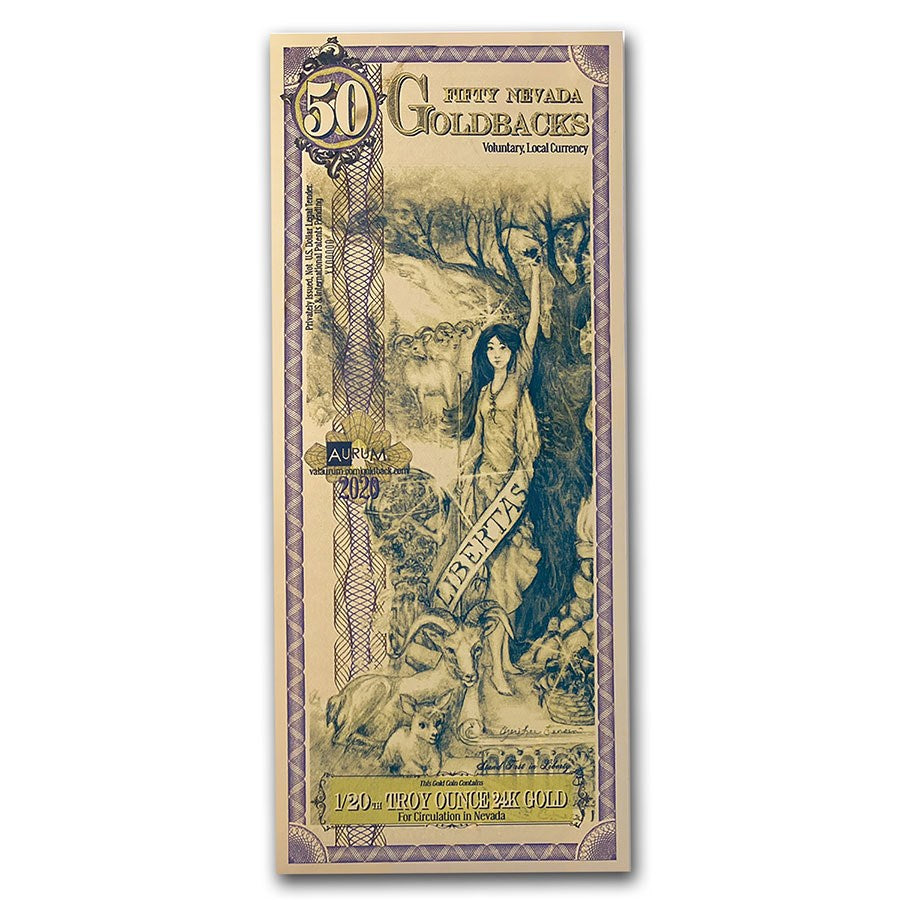

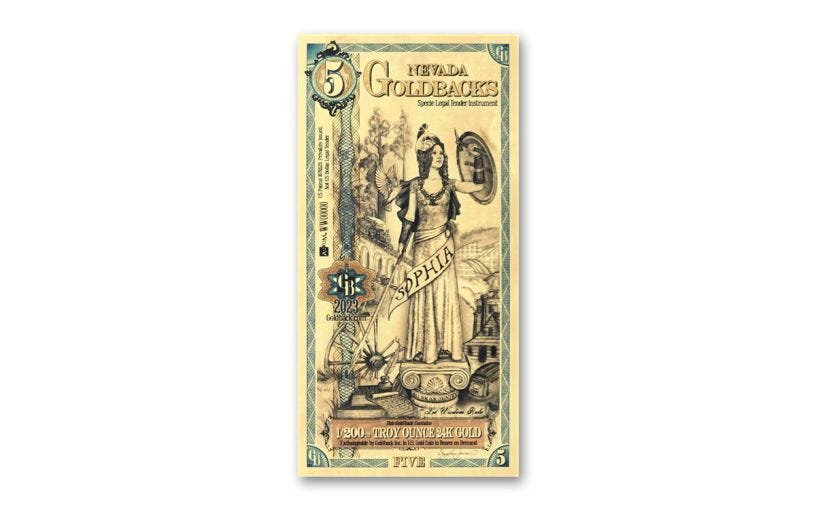

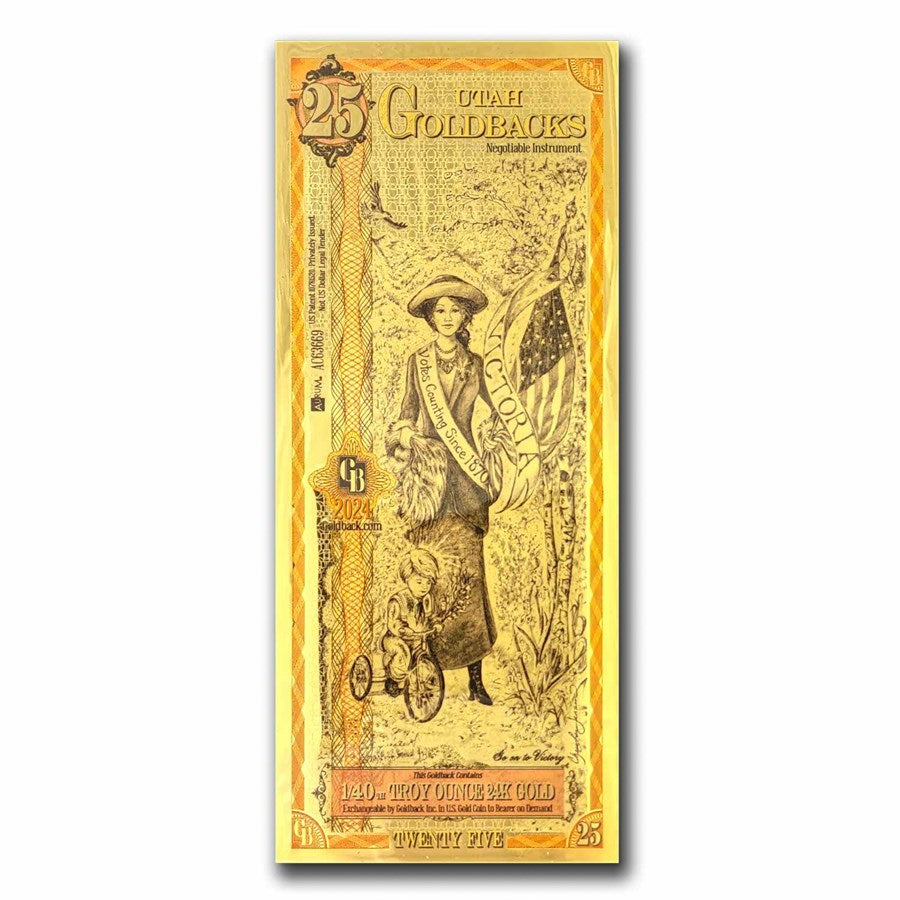

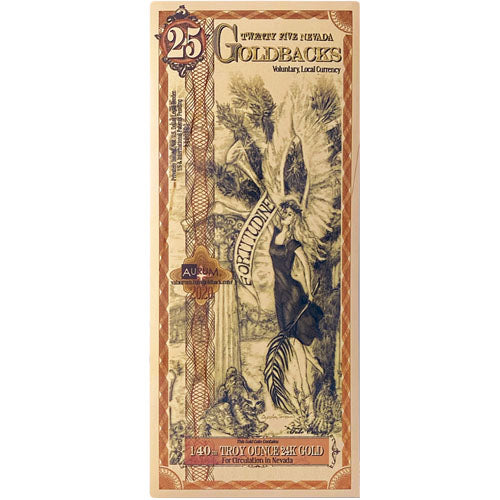

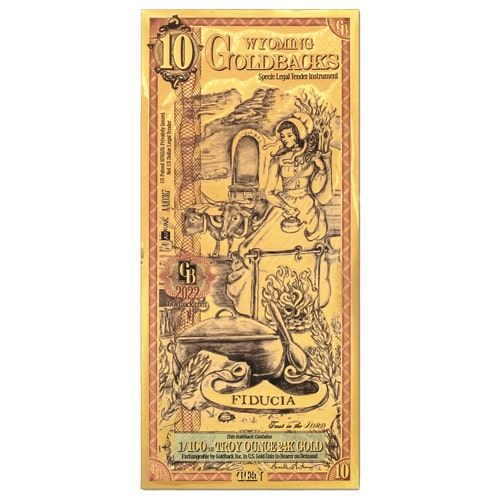

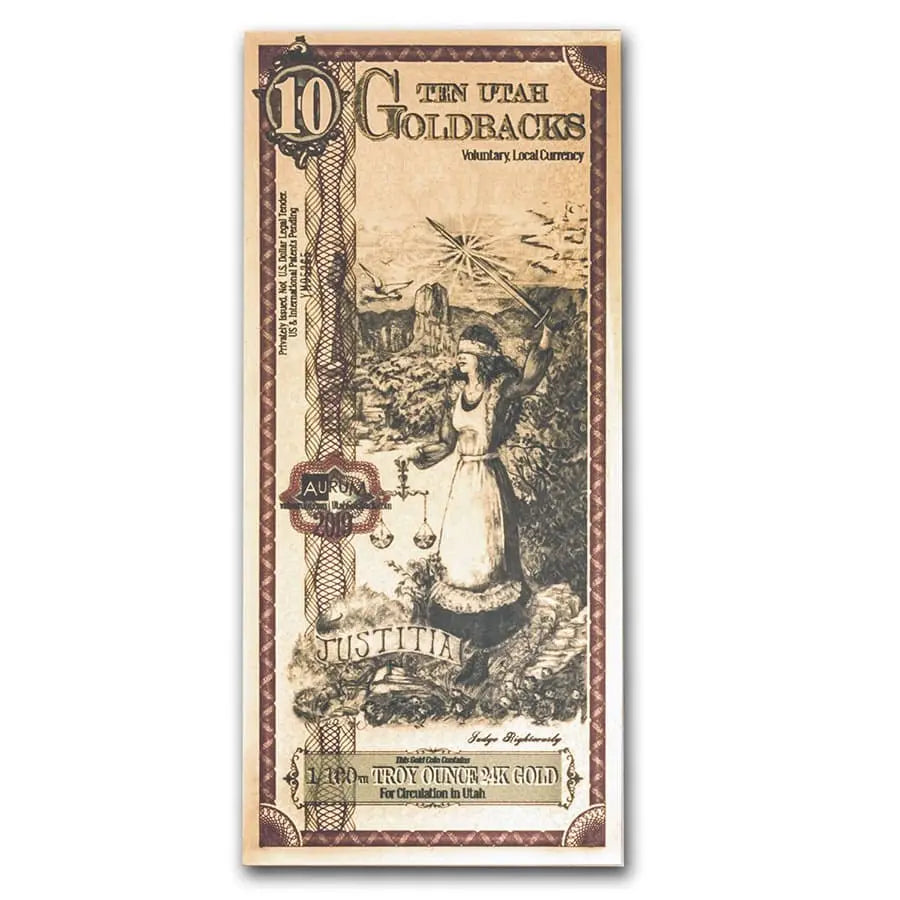

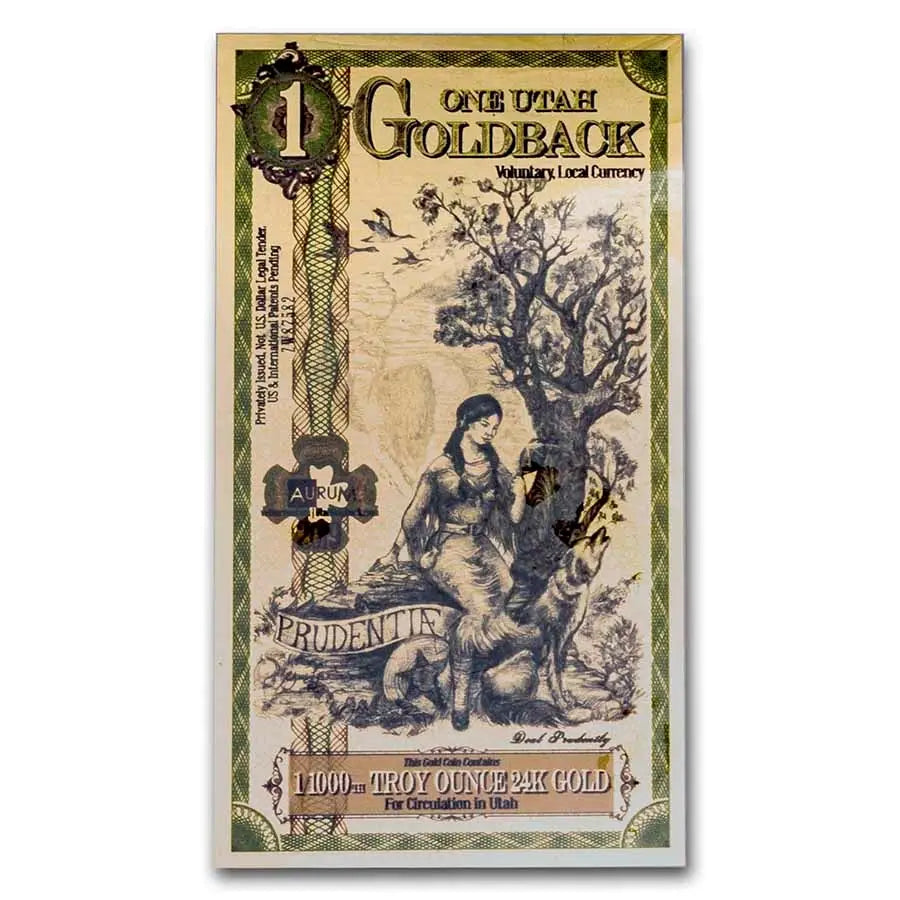

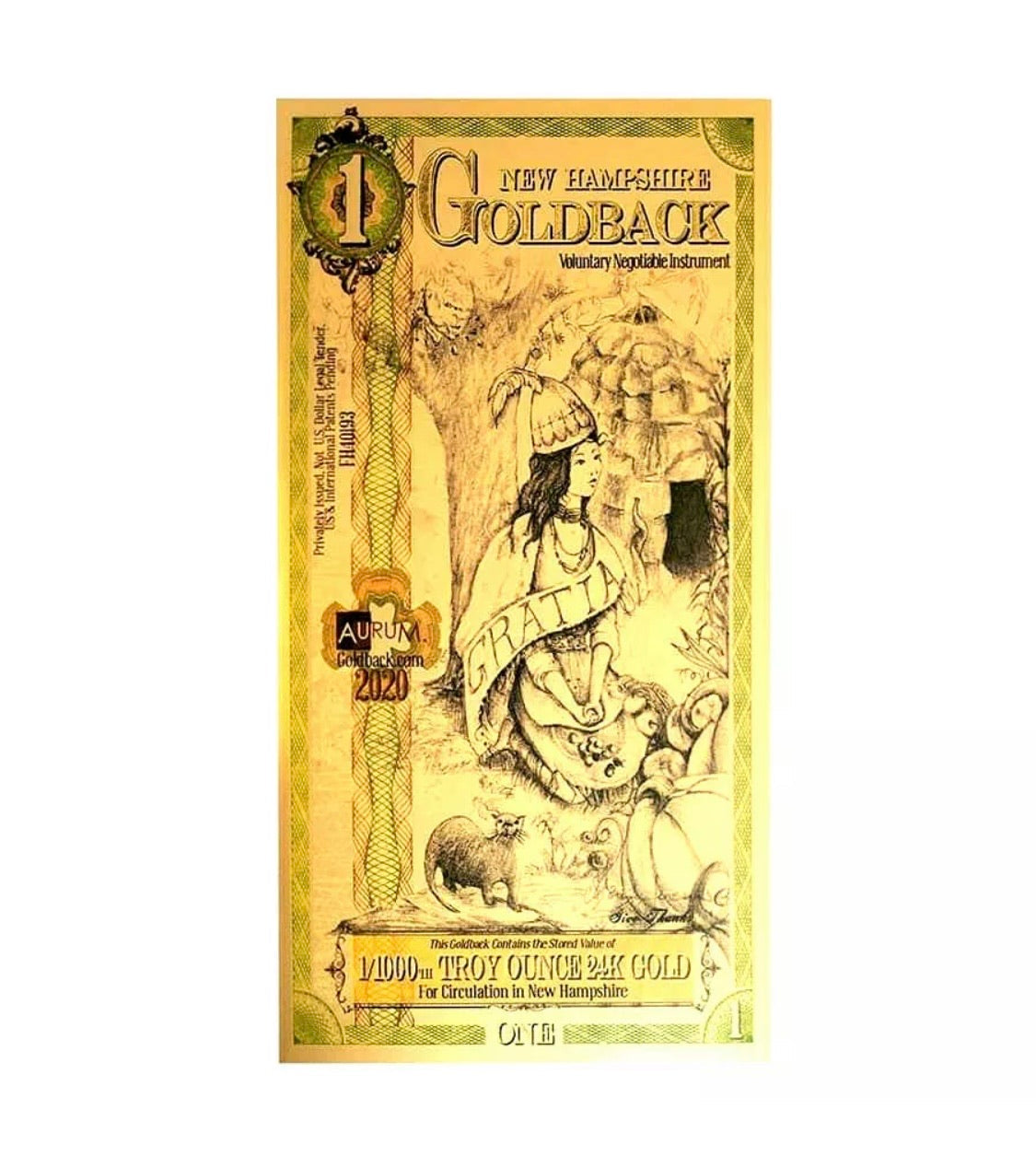

The removal of the gold standard marked a turning point where monetary policy, globalization, and technological changes began to benefit capital over labor. Addressing this imbalance requires systemic reforms, such as strengthening labor rights, addressing inflation, and rethinking how productivity gains are shared across society. While returning to the gold standard is unlikely, Goldbacks gave a solution to combat wage stagnation and the lessons from pre-1971 era remind us of the importance of aligning economic growth with workers’ well-being.