Sound Money vs. Fiat Money: Understanding the Fundamentals of Value

In today’s world, money is the lifeblood of economies, but not all money is created equal. The debate between sound money and fiat money has been at the heart of economic discussions for decades, influencing how societies perceive value, stability, and trust in their monetary systems. This blog explores the key differences between sound money and fiat money, their historical contexts, and their implications for individuals and economies.

What is Sound Money?

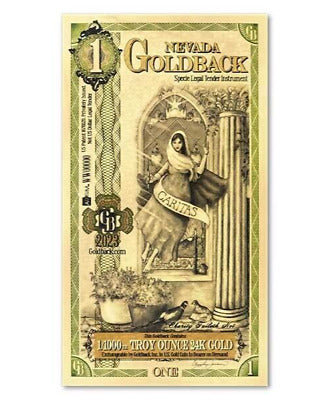

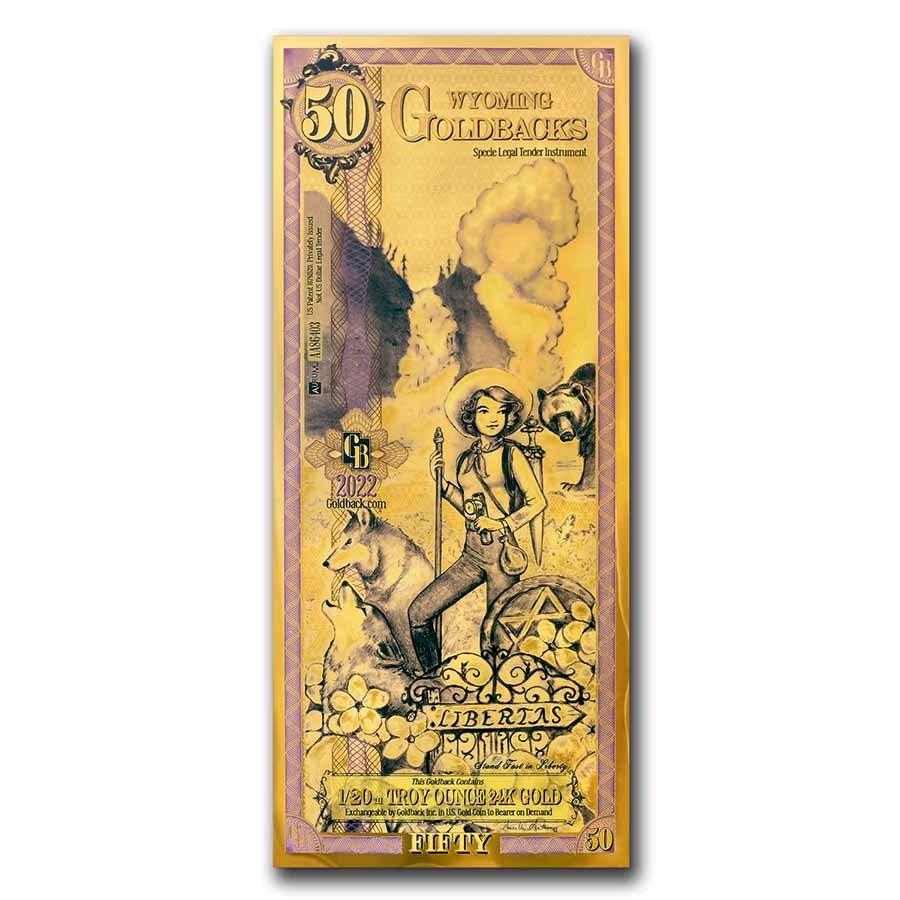

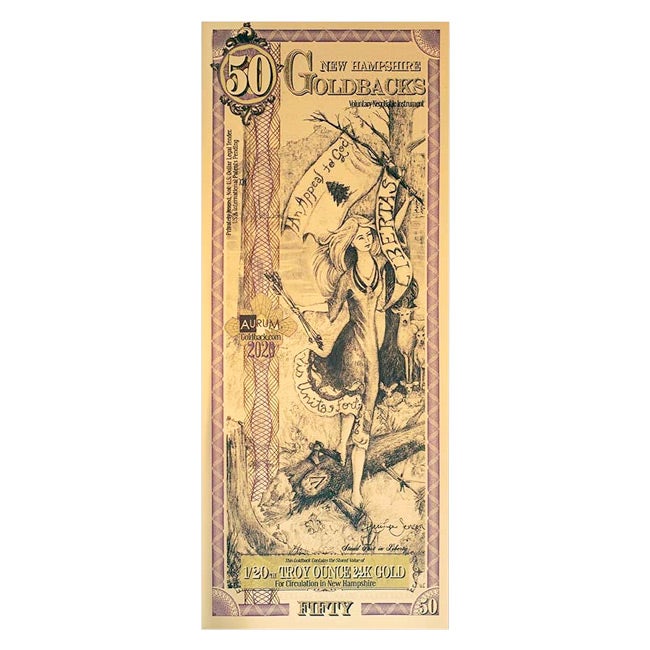

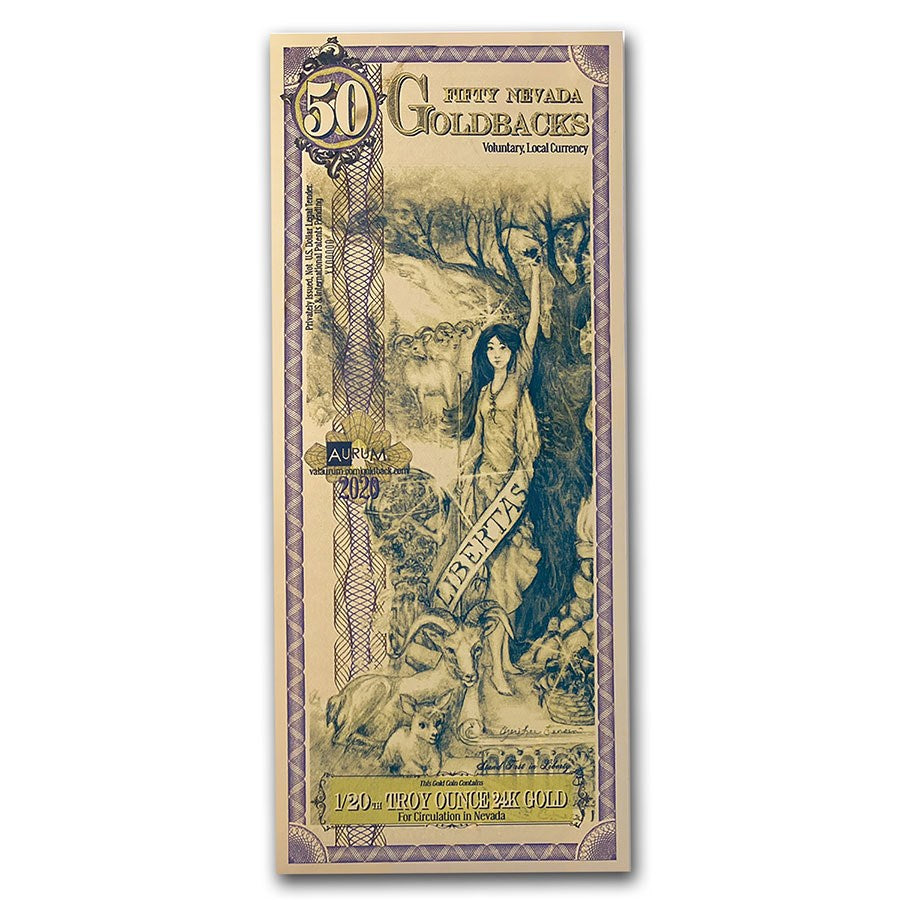

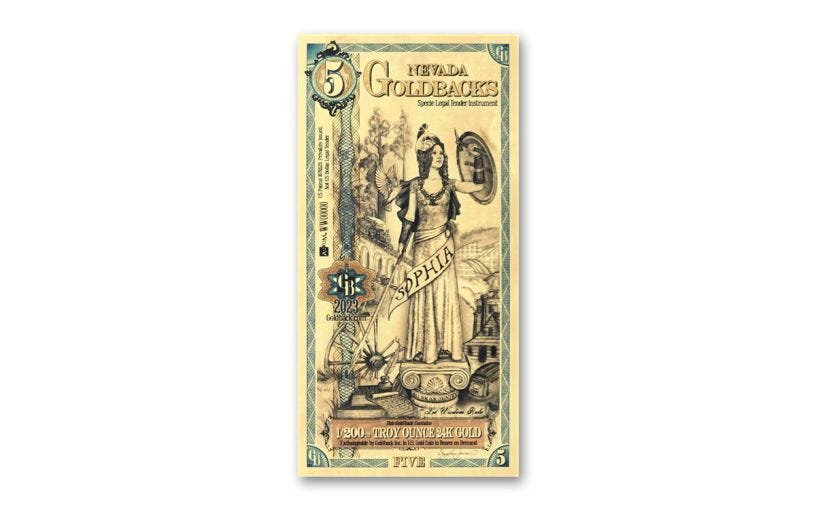

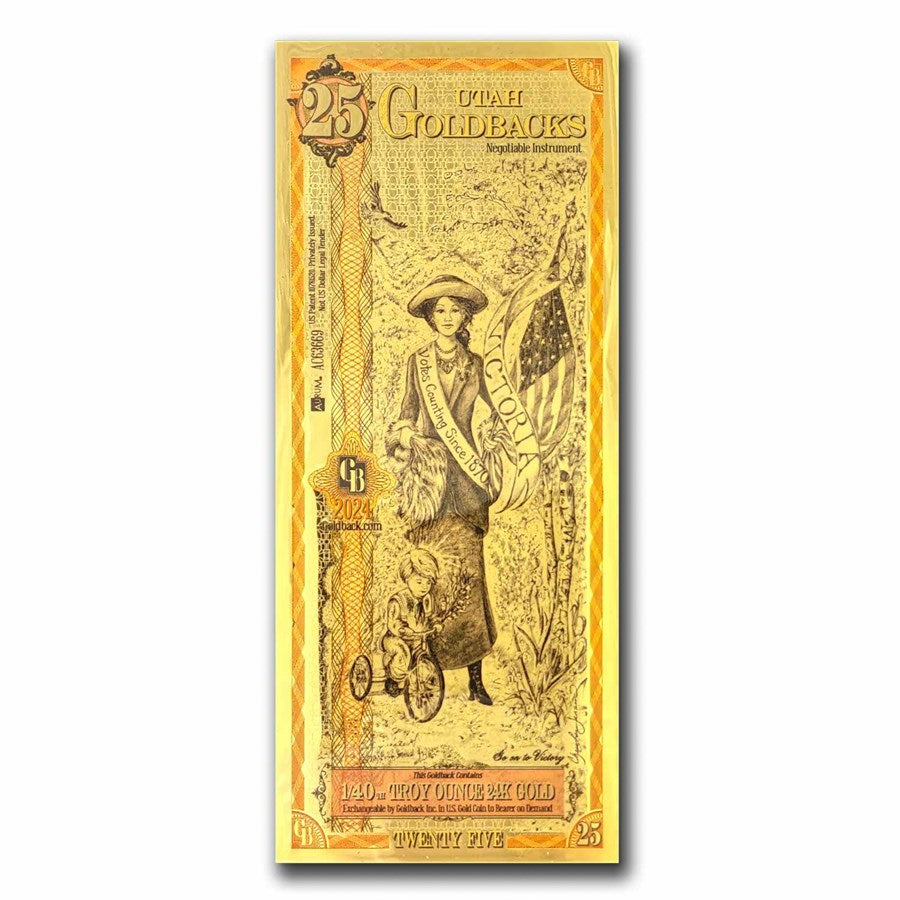

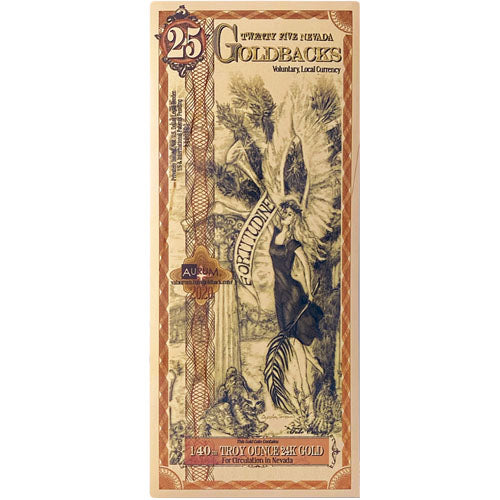

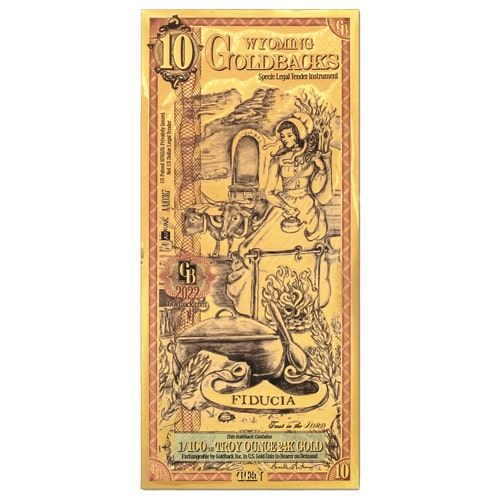

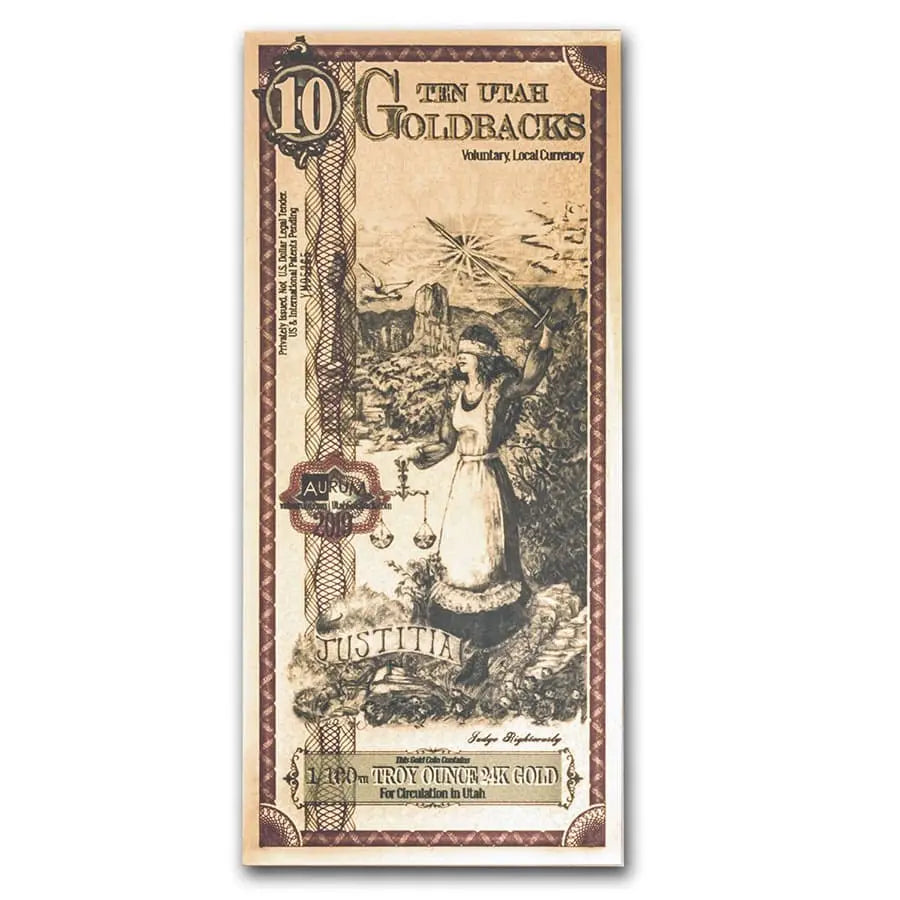

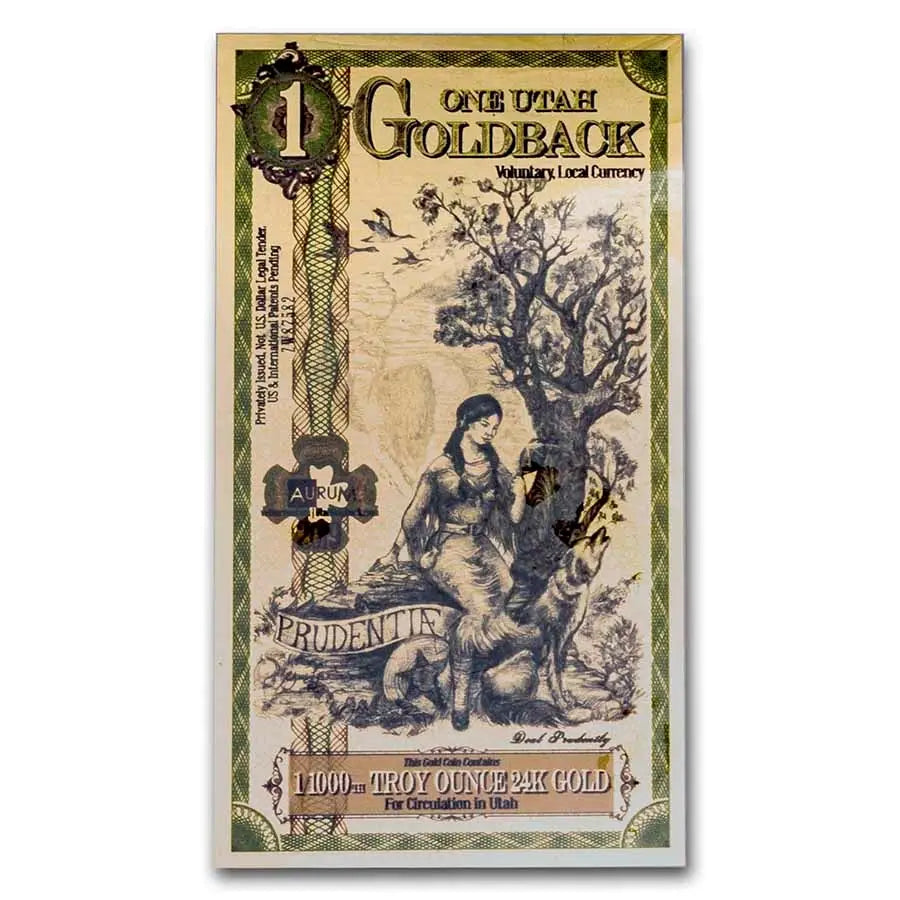

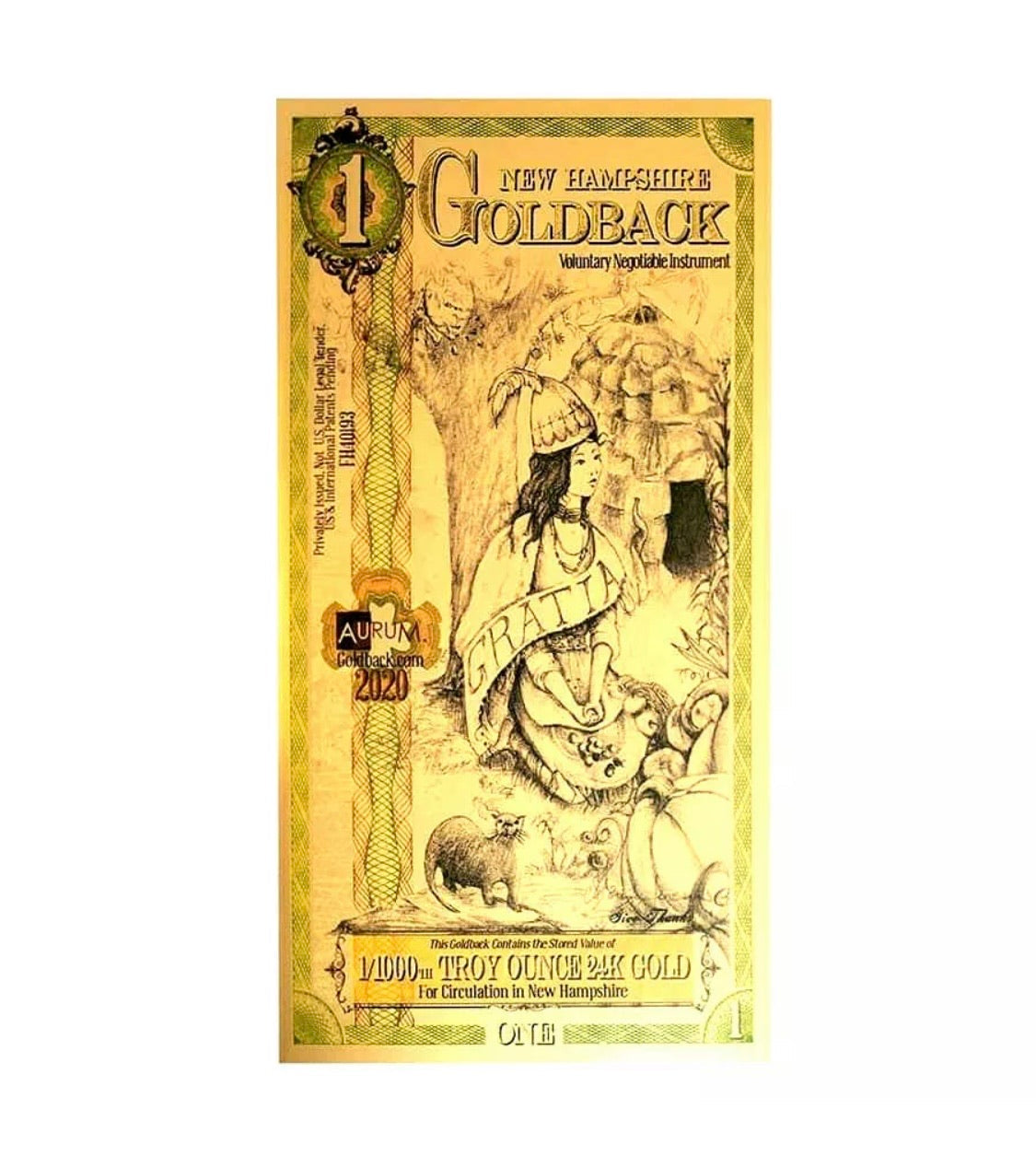

Sound money refers to a monetary system that is stable, durable, and often backed by tangible assets like gold or silver. It derives its value from scarcity, utility, and intrinsic worth. Historically, sound money systems have been used to anchor economies, providing a hedge against inflation and fostering trust in the currency.

Characteristics of Sound Money:

1. Intrinsic Value: Often tied to physical commodities like gold or silver.

2. Scarcity: Limited supply ensures stability in value.

3. Trust and Stability: People trust sound money because it cannot be easily manipulated by governments or central banks.

4. Long-Term Purchasing Power: Maintains value over time, protecting savings from inflation.

Example: The Gold Standard, used widely in the 19th and early 20th centuries, is a prime example of sound money.

What is Fiat Money?

Fiat money, on the other hand, is currency that has no intrinsic value and is not backed by a physical commodity. Its value is derived solely from government decree and the trust of the people who use it. Fiat currencies dominate modern economies, with examples including the US Dollar, Euro, and Japanese Yen.

Characteristics of Fiat Money:

1. No Intrinsic Value: Its worth depends on government backing and public trust.

2. Unlimited Supply: Central banks can print fiat money at will, leading to potential inflation.

3. Flexibility: Governments can adjust the money supply to address economic crises.

4. Short-Term Stability: While stable in the short term, fiat money is susceptible to long-term devaluation.

Example: The US Dollar after 1971, when it was decoupled from the Gold Standard.

The Case for Sound Money

Advocates of sound money argue that it promotes economic stability and discourages reckless monetary policies. Here’s why:

1. Inflation Control: With limited supply, sound money is less prone to inflation.

2. Encourages Savings: People are more likely to save when money retains its value over time.

3. Economic Discipline: Governments cannot easily manipulate the money supply, promoting fiscal responsibility.

However, sound money systems can be rigid, making it harder for governments to respond to economic crises or stimulate growth.

The Case for Fiat Money

Fiat money supporters highlight its flexibility and utility in modern economies. Key advantages include:

1. Economic Growth: Governments can inject money into the economy to stimulate demand.

2. Crisis Management: Central banks can print money to address recessions or financial crises.

3. Global Trade: Fiat money facilitates complex international trade and financial systems.

The downside is the risk of hyperinflation and loss of public trust if monetary policies are mismanaged.

Conclusion: Choosing the Right System

The debate between sound money and fiat money is not merely academic—it has real-world implications for economic stability, individual wealth, and global trade. While fiat money offers flexibility and adaptability, sound money provides a foundation of trust and stability.

Ultimately, the ideal monetary system may not lie in choosing one over the other but in finding a balance that combines the stability of sound money with the adaptability of fiat systems. As technology evolves and global economies face new challenges, the future of money remains an open question, inviting us to rethink how we define and preserve value in an ever-changing world.