Why CBDCs Are Bad for Society & Why Goldbacks Are a Better Solution

Central Bank Digital Currencies (CBDCs) may sound like a modern convenience, but they pose serious risks to financial freedom. Unlike cash, CBDCs allow governments to track, control, and even restrict how and where you spend your money. They can enforce negative interest rates, freeze accounts, or limit purchases based on social credit scores or government policies. This level of control threatens privacy, autonomy, and the very concept of financial independence.

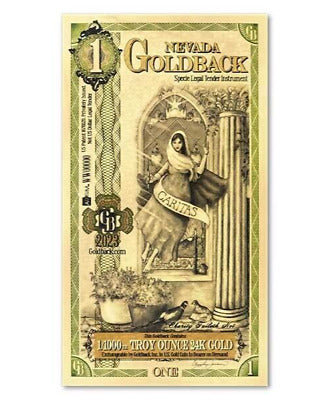

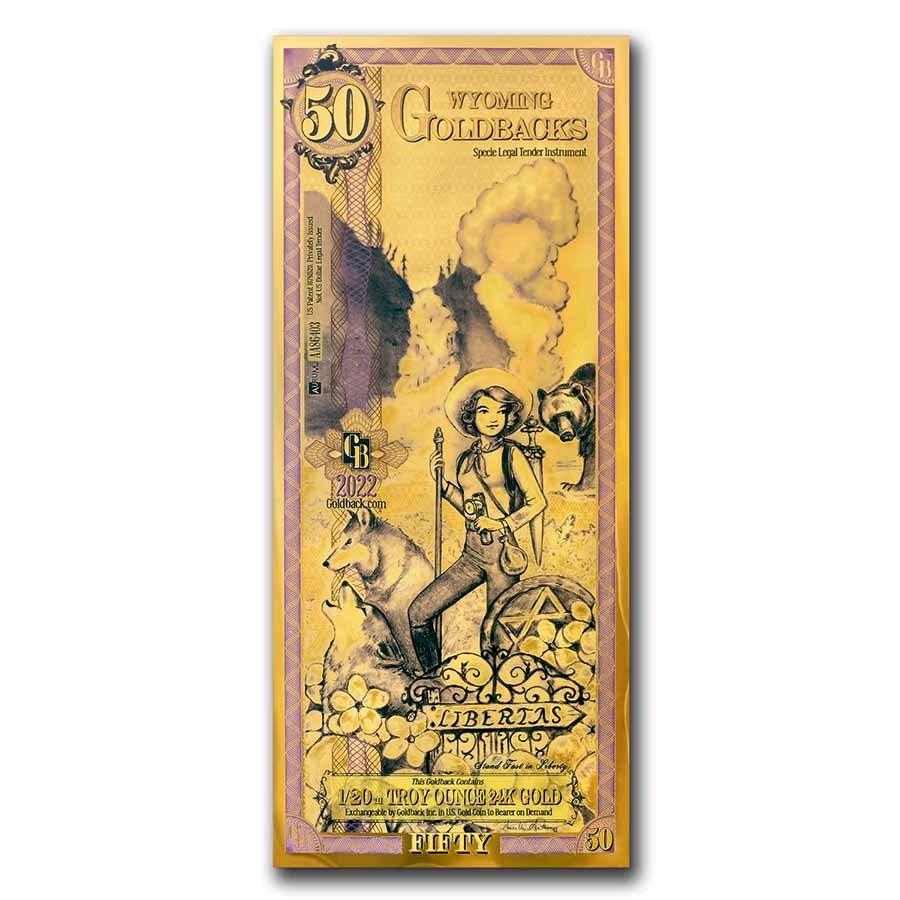

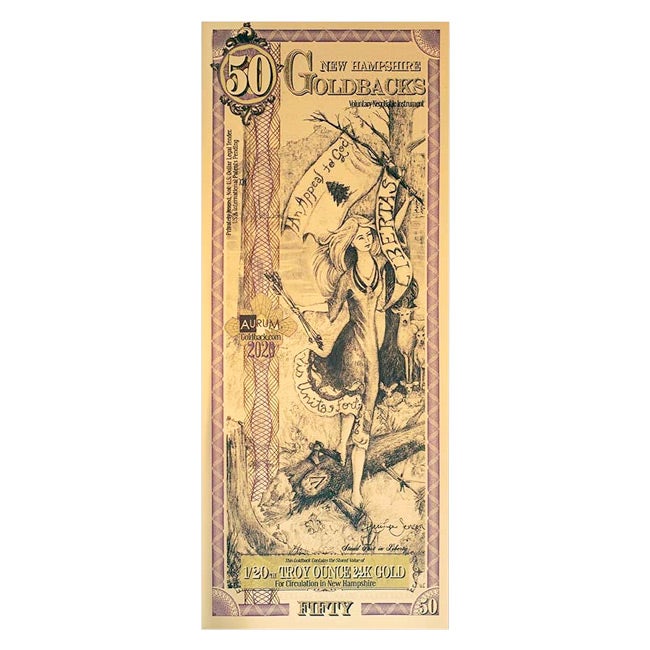

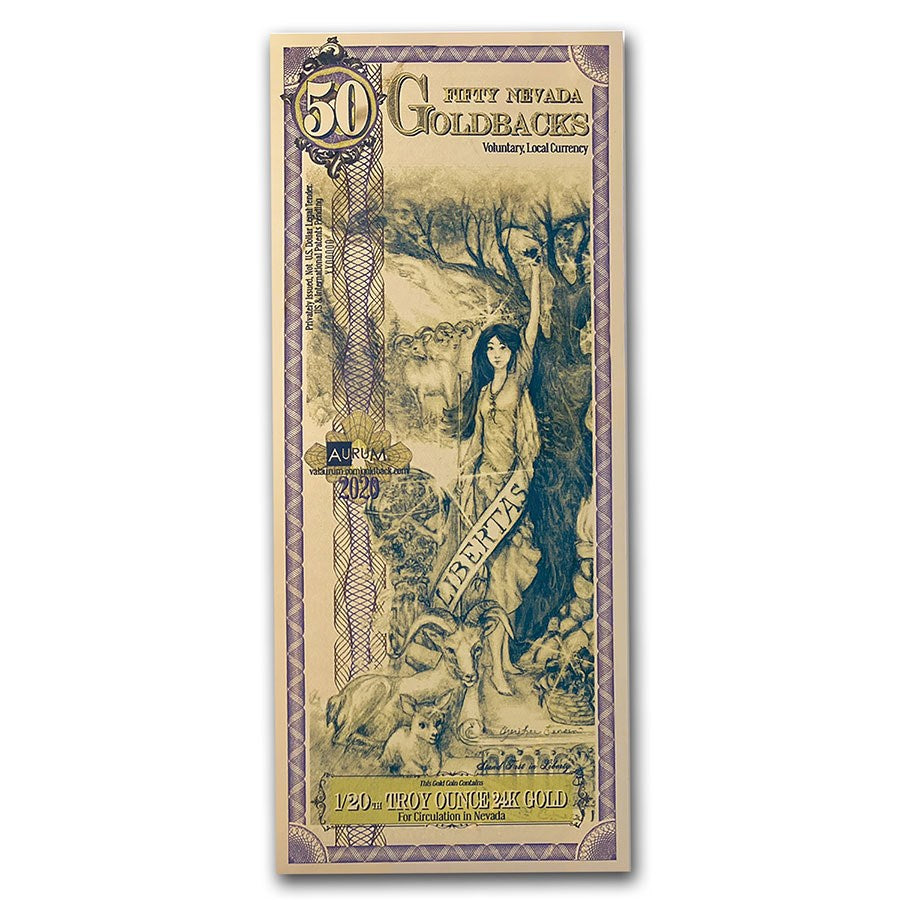

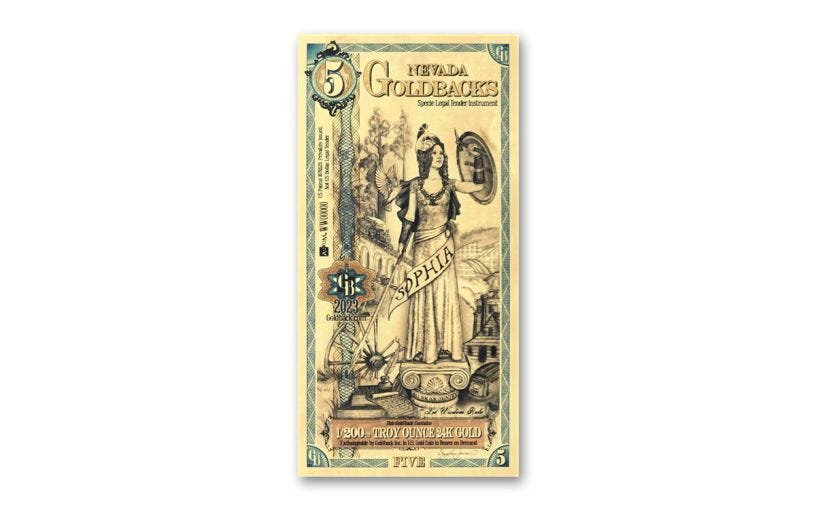

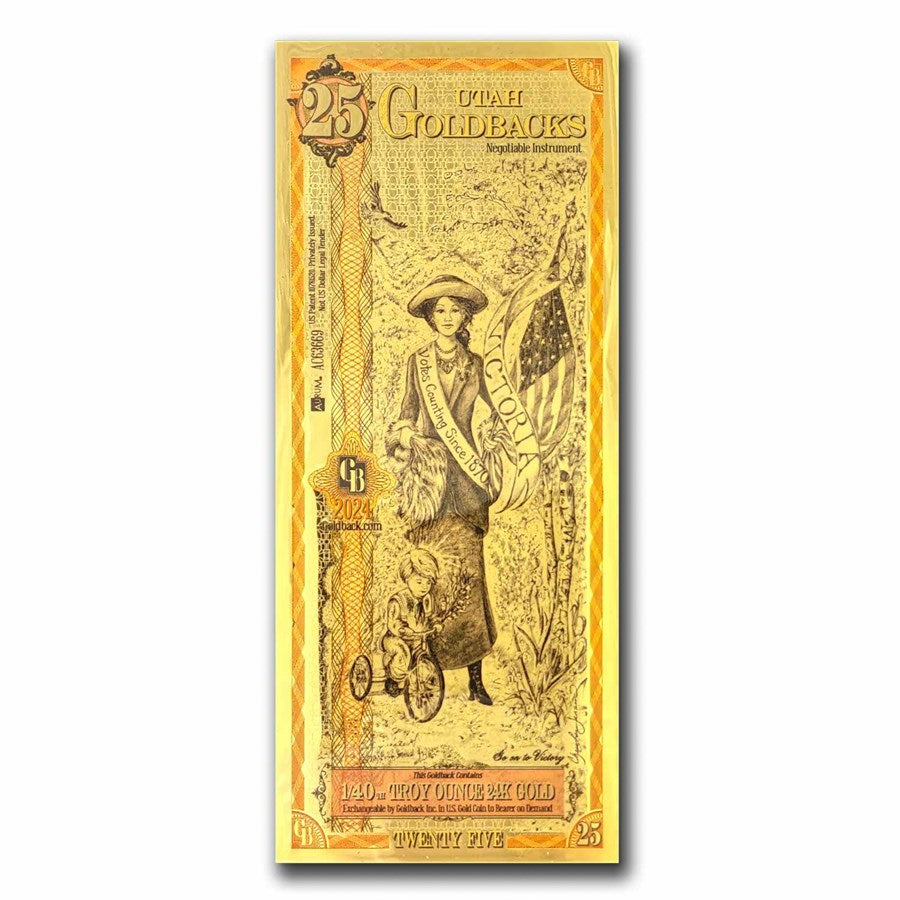

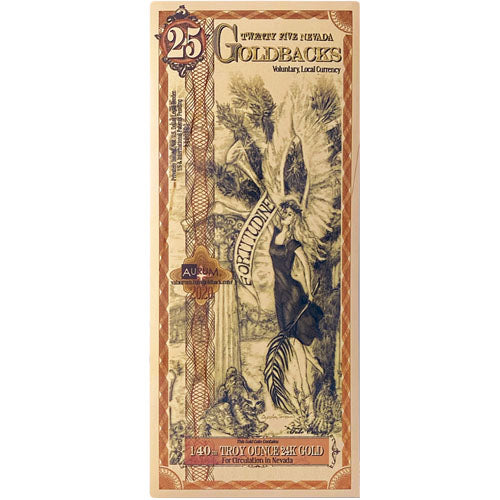

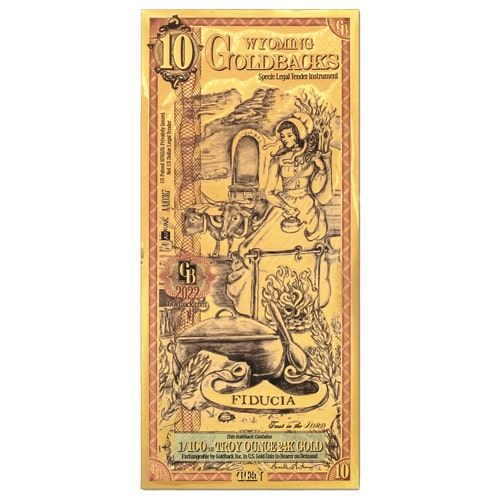

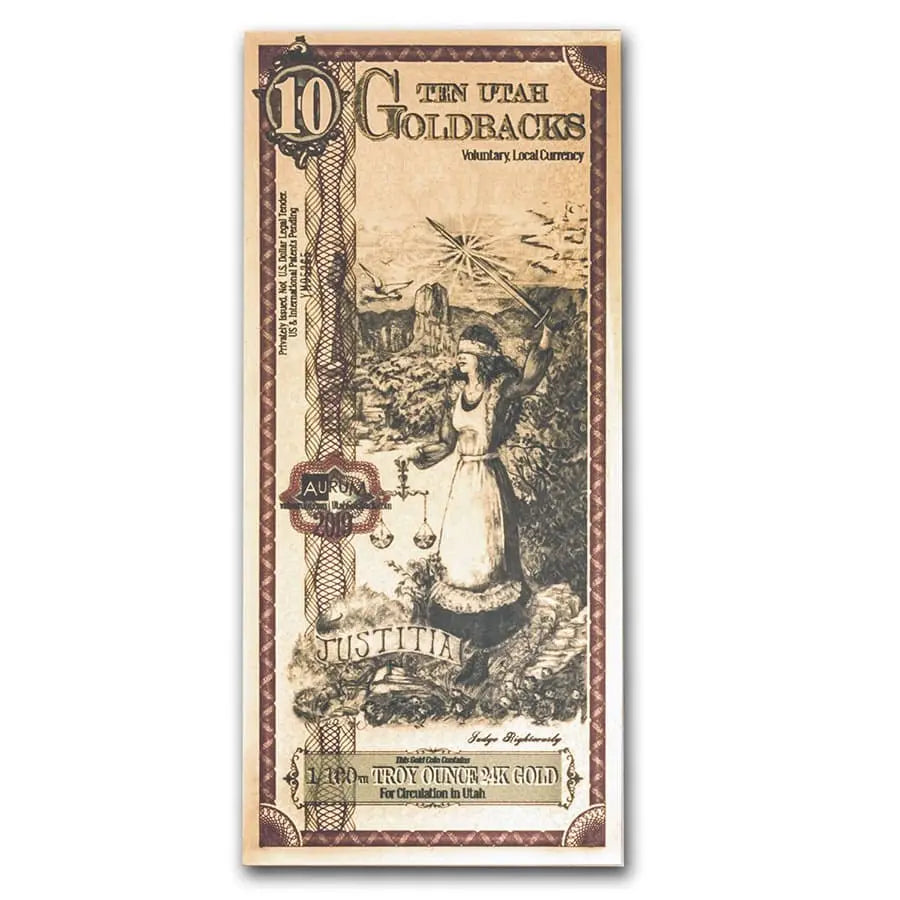

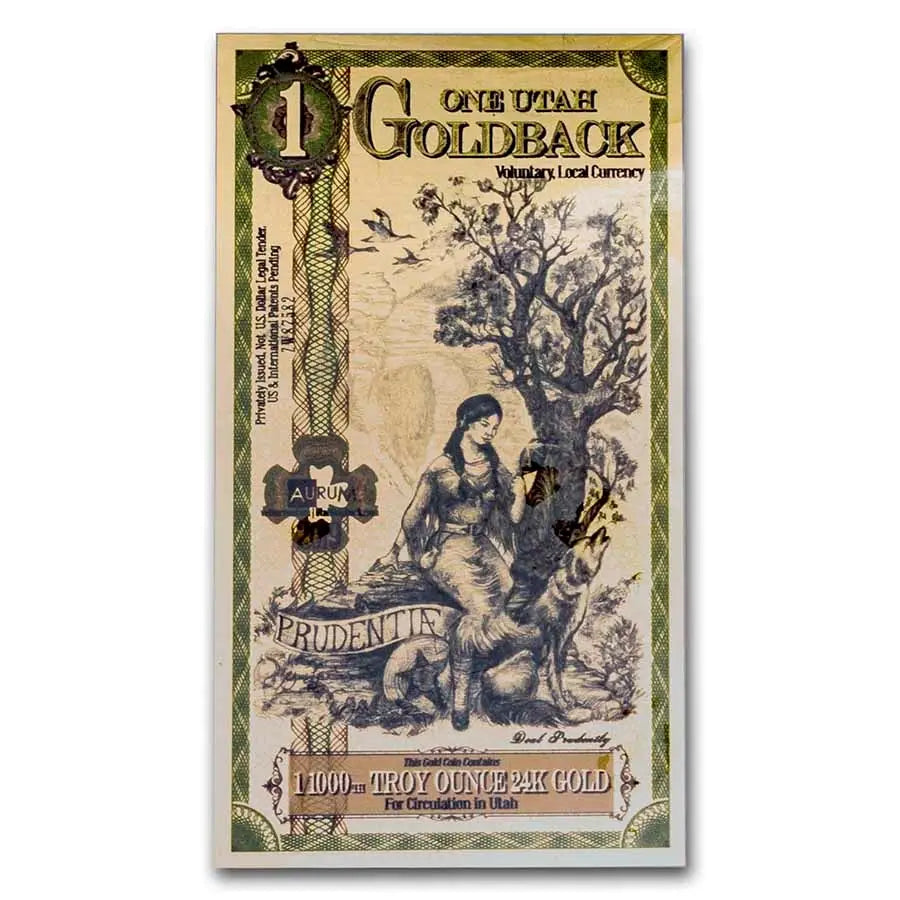

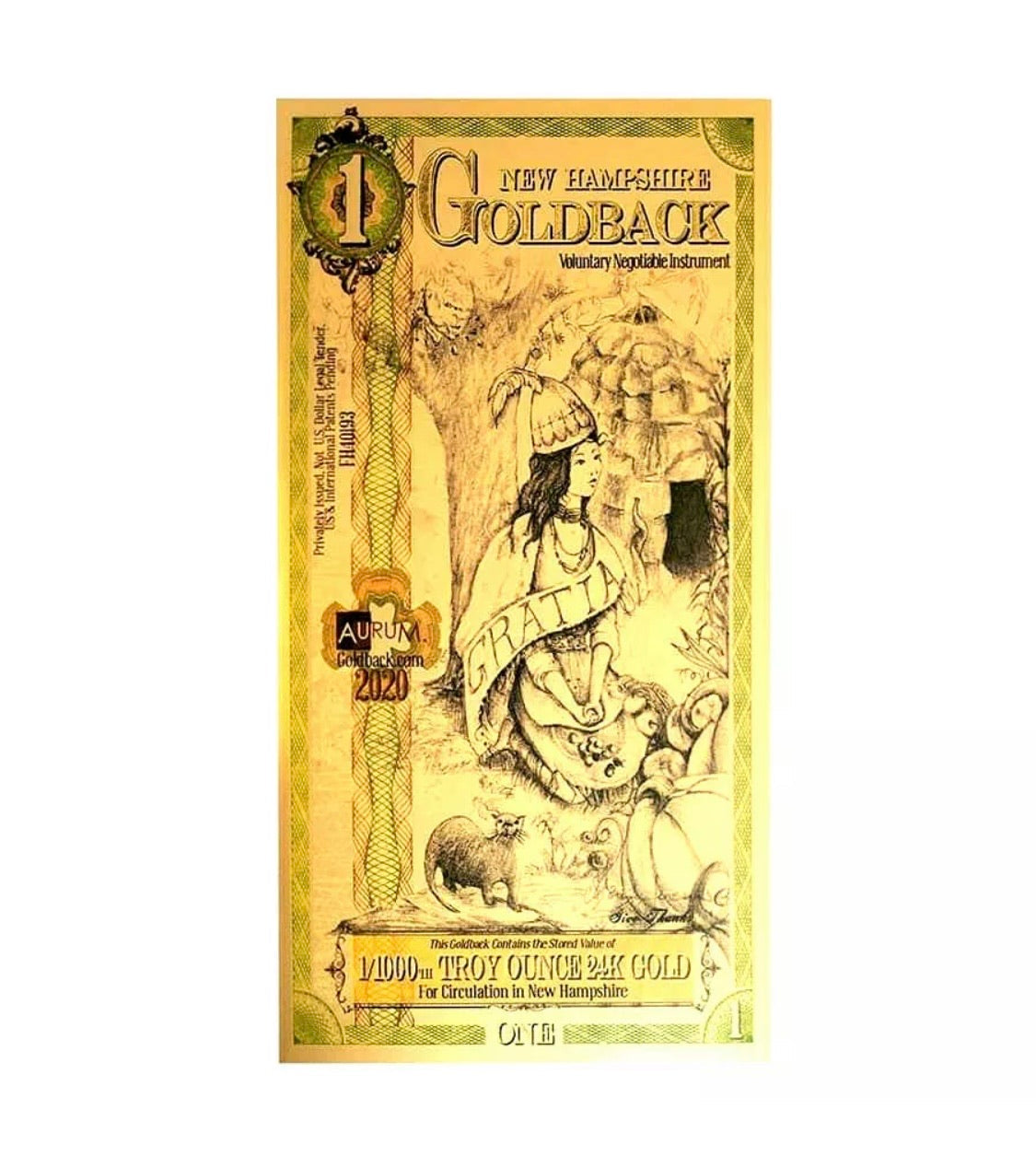

Goldbacks, on the other hand, provide a tangible, private, and inflation-resistant alternative. Unlike fiat money, which loses value due to inflation, Goldbacks are physical gold-infused currency that retains purchasing power over time. They allow for decentralized, voluntary transactions without reliance on banks or government-controlled systems.

CBDCs push society towards an era of surveillance-driven financial control, while Goldbacks empower individuals with real, asset-backed money that can’t be manipulated by central authorities. If freedom matters, choosing gold over government-controlled digital money is the smarter path forward.