Why my friend keeps trying to convince me that the World Economic Forum (WEF) and globalization are a net positive for society, especially when paired with cryptocurrency?

Why my friend keeps trying to convince me that the World Economic Forum (WEF) and globalization are a net positive for society, especially when paired with cryptocurrency? He argues that crypto represents the future of a borderless, digital economy where financial power is decentralized and accessible to everyone. To him, the Goldback—a physical, gold-infused currency—is outdated, inefficient, and too limited for a modern, interconnected world. “Crypto is the key to financial freedom,” he insists. “It’s secure, fast, and can’t be controlled by governments like fiat money. Plus, the WEF is pushing for a more unified world economy, which means more opportunities for innovation and wealth creation!” He sees the global adoption of digital assets as the next step in human progress, where economic barriers disappear and prosperity flows more freely.

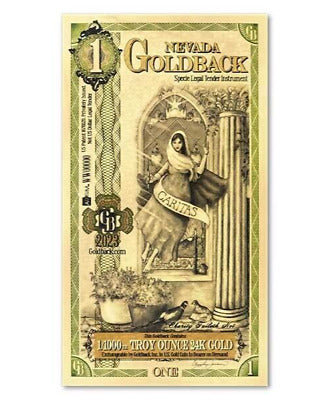

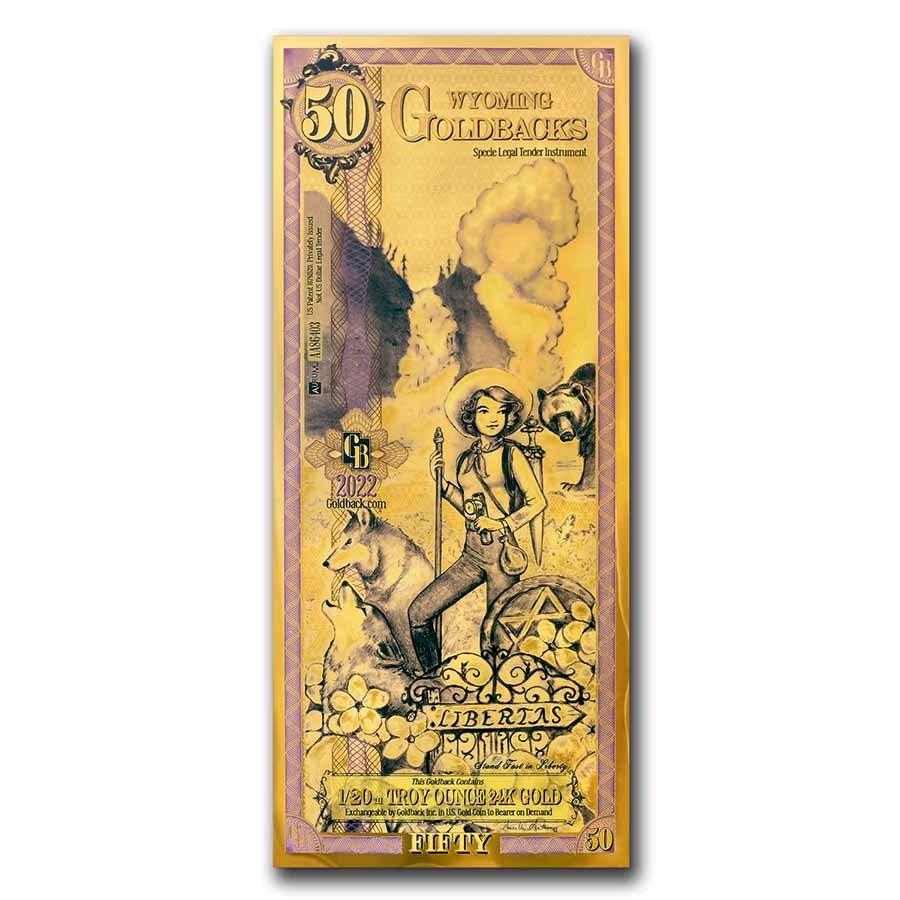

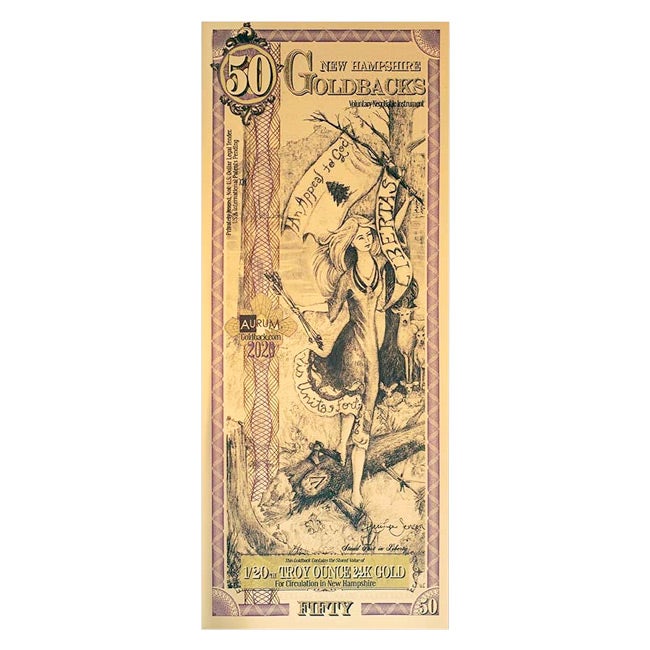

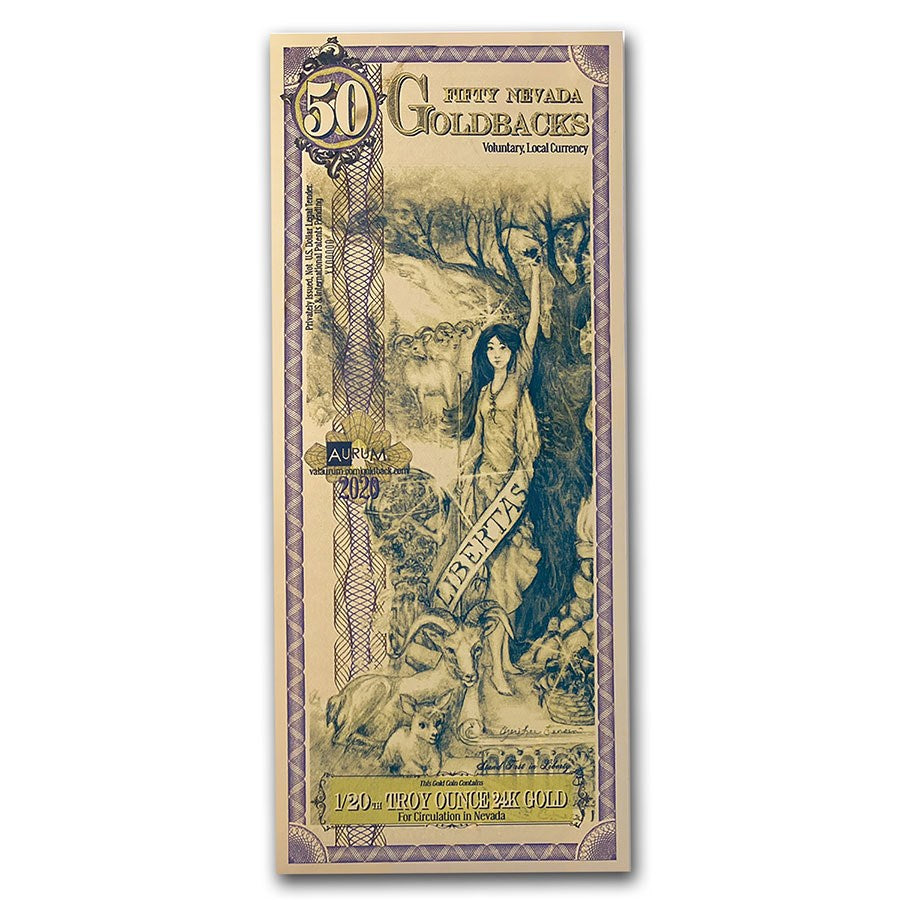

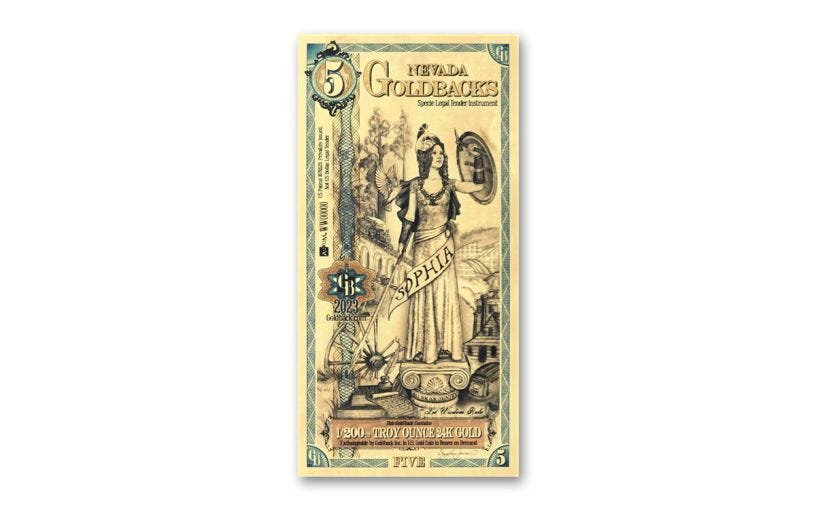

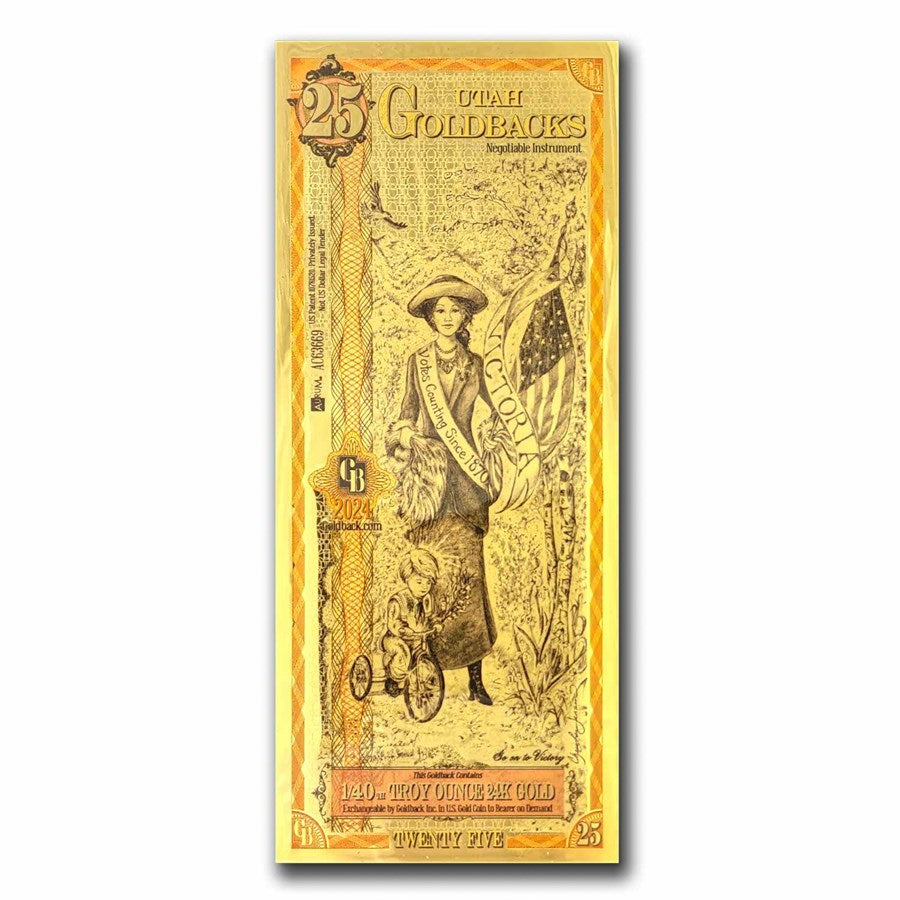

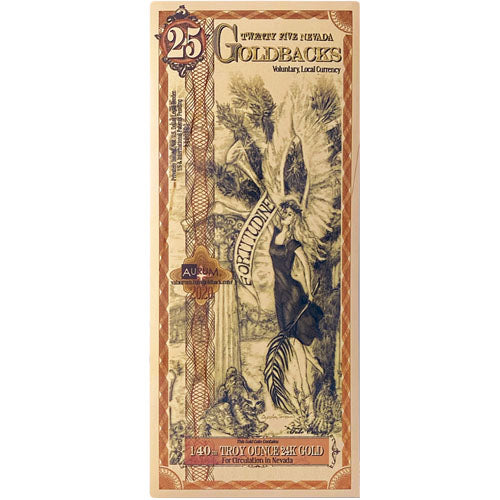

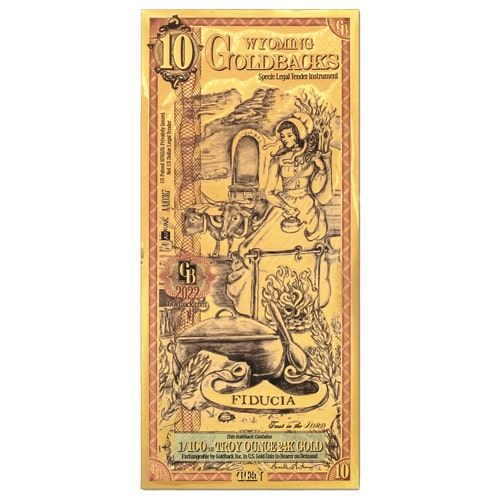

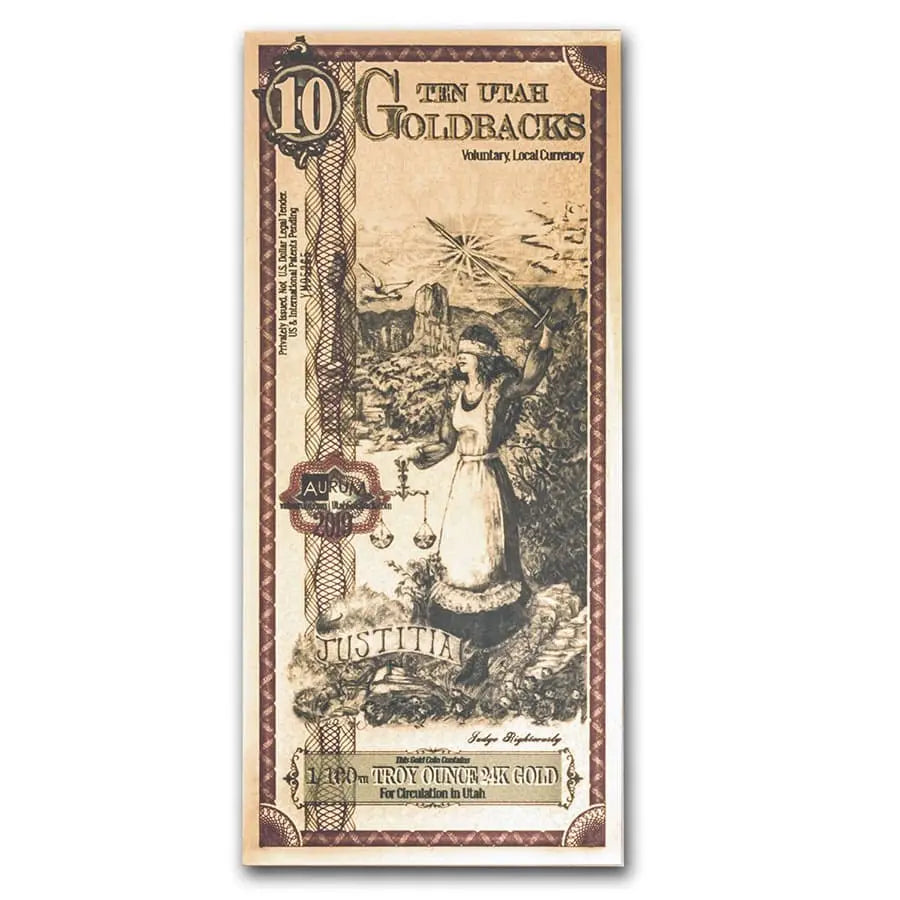

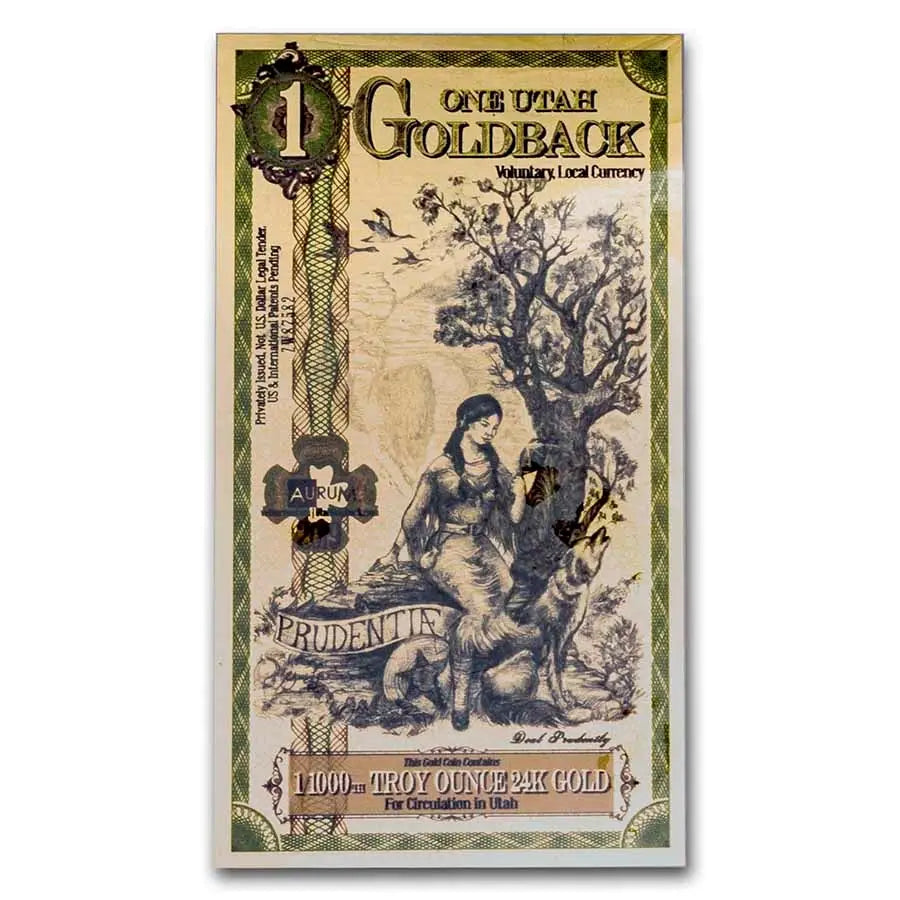

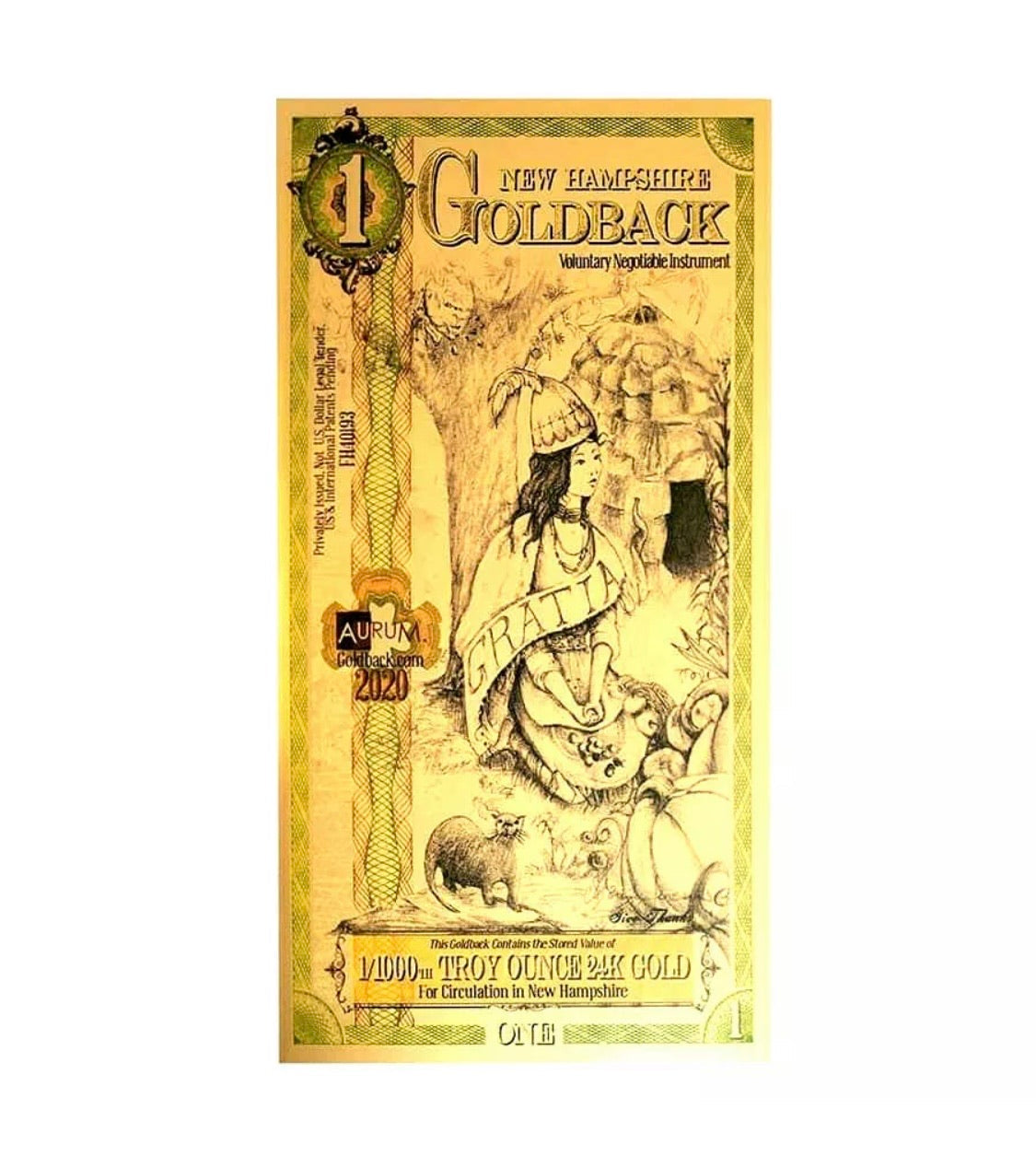

But I can’t shake my skepticism. While I see the convenience of crypto, I don’t trust a system that relies entirely on the internet, corporations, and centralized regulations disguised as decentralization. The WEF’s vision of globalization might work for big investors and tech elites, but what about regular people who prefer tangible, time-tested value? I pull out a Goldback from my wallet and show it to him. “This has real, intrinsic value,” I say. “If everything collapses—markets, networks, even governments—this still holds worth. Can you say the same about your crypto?” He scoffs, calling me a gold bug, but deep down, I can tell he knows I have a point. The digital future might be coming fast, but I’d rather have something solid in my hands than trust a system built on promises and speculation.