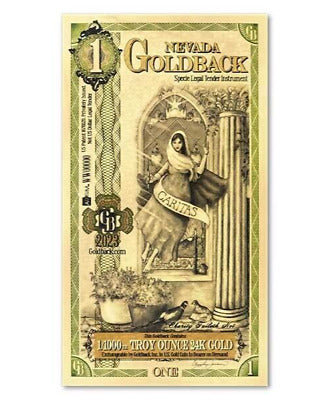

The Tangibility of Goldback

The tangibility of Goldbacks offers several advantages over cryptocurrencies, particularly for individuals who value physical assets or are concerned about the volatility and technological dependencies of digital currencies. Here’s why Goldbacks’ tangibility is often considered better:

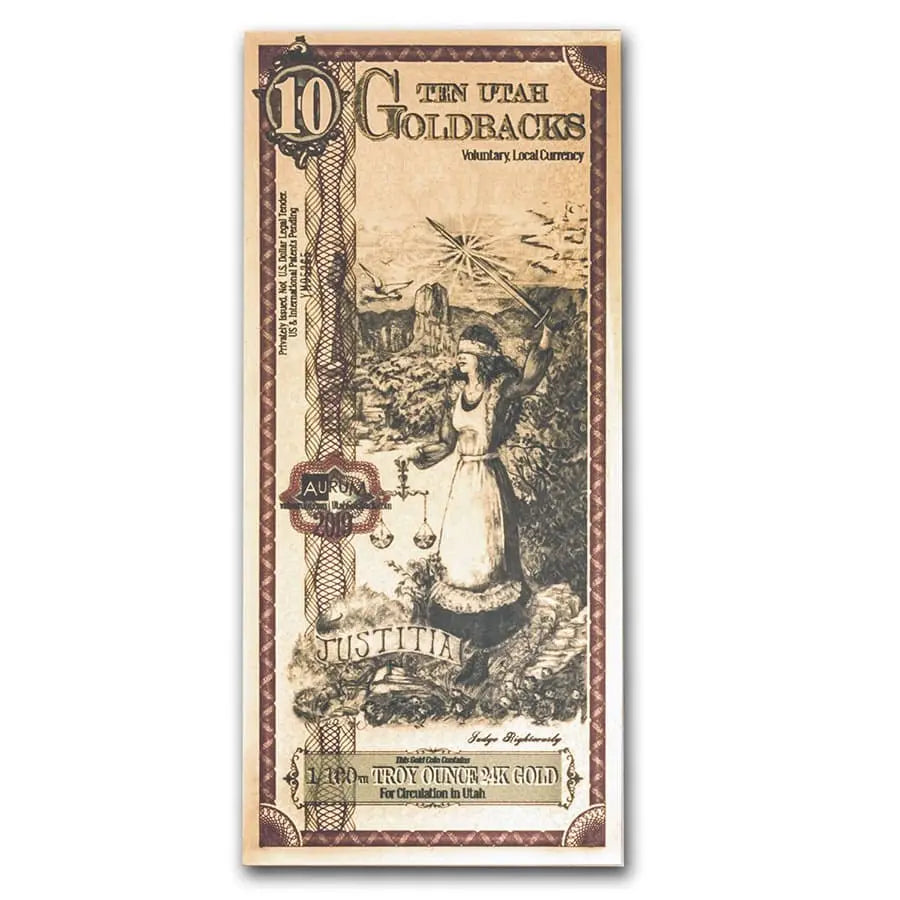

1. Intrinsic Value

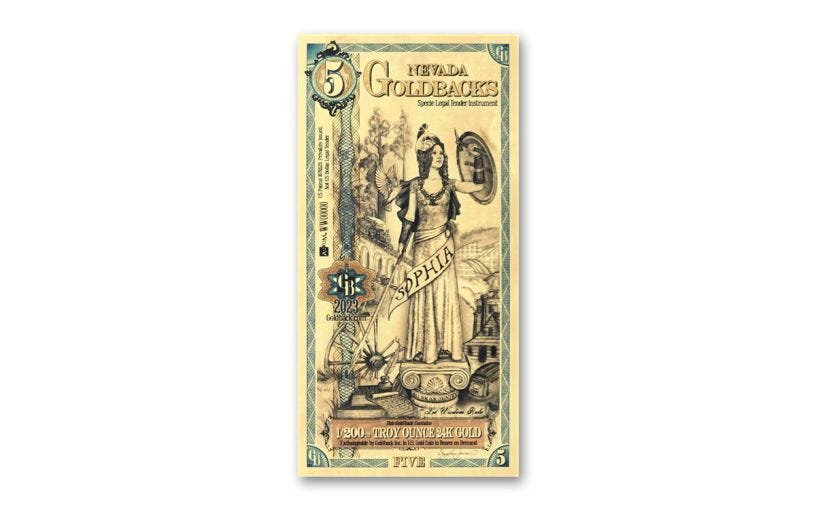

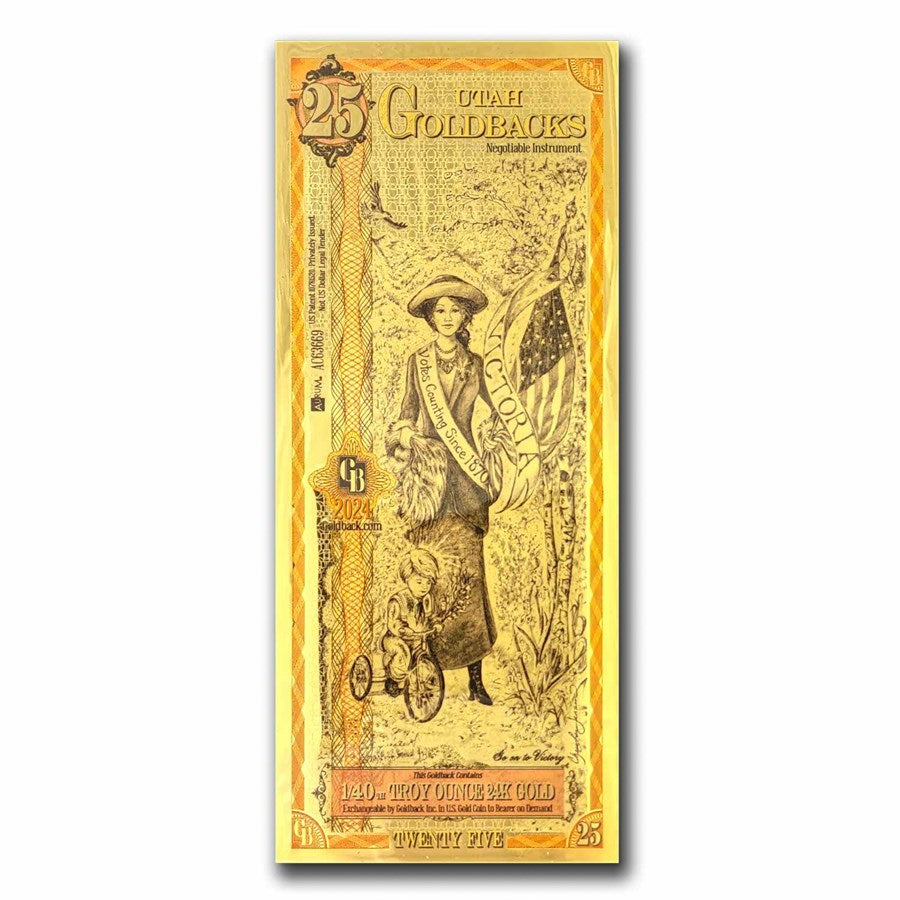

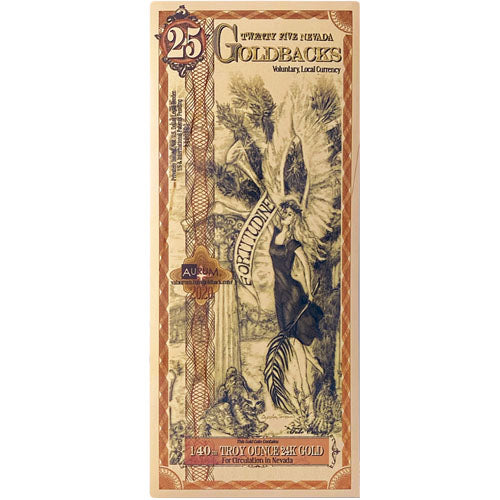

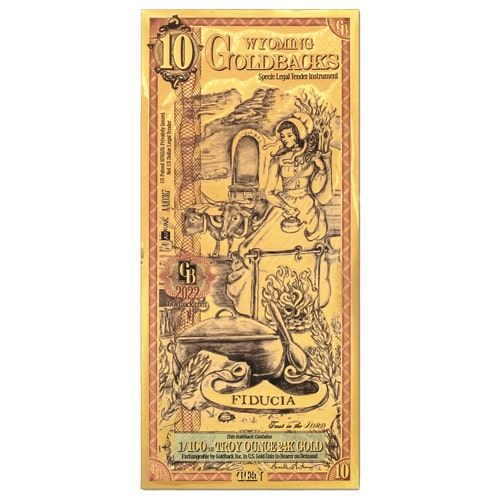

• Goldbacks are made with actual gold, giving them intrinsic value derived from the precious metal itself. This physical backing ensures that their worth is tied to a tangible asset.

• Cryptocurrencies, by contrast, derive their value from supply, demand, and trust in the blockchain technology, which can be more abstract and speculative.

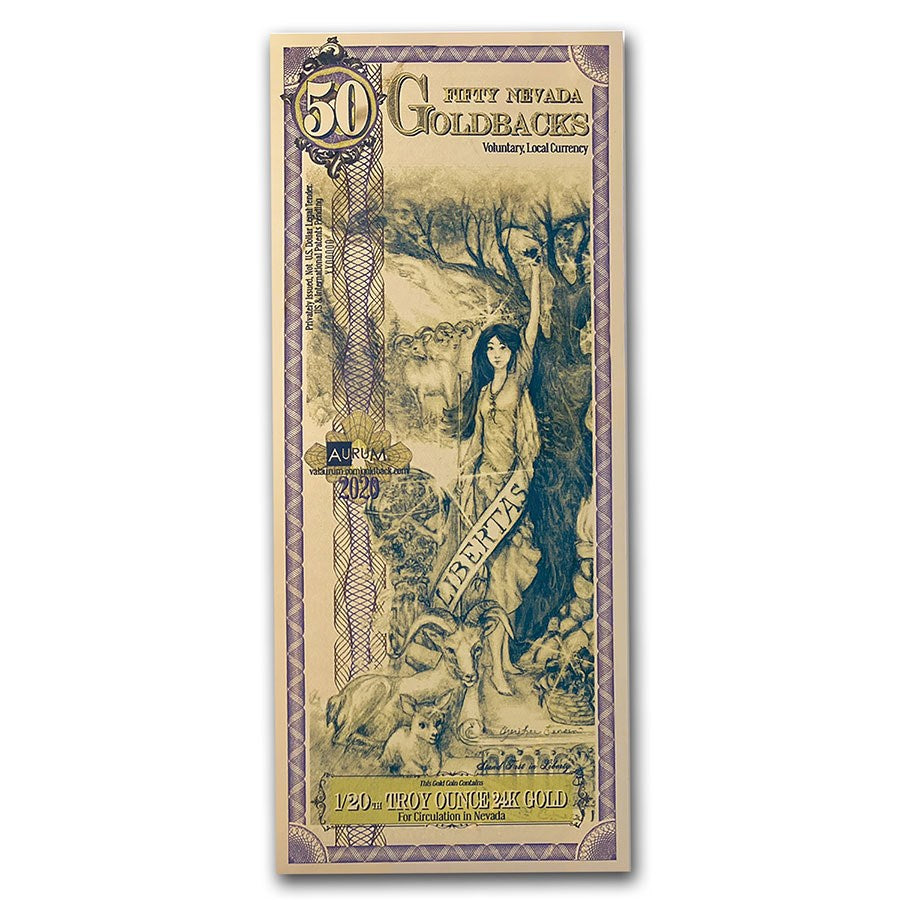

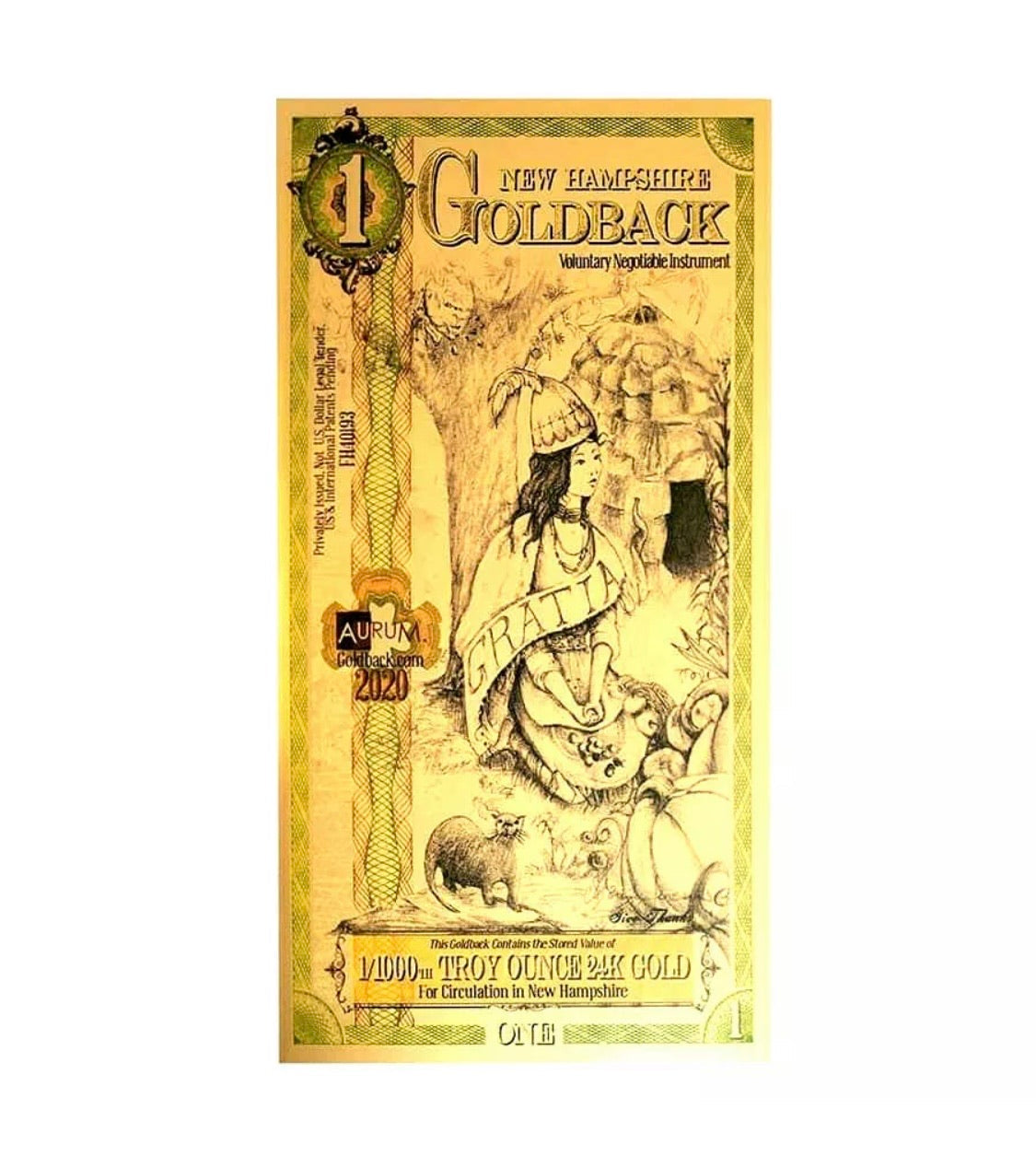

2. No Dependence on Technology

• Goldbacks are physical and do not rely on electricity, internet access, or digital wallets to exist or be used. They can function as currency in scenarios where technology fails, such as during power outages or cyberattacks.

• Cryptocurrencies, on the other hand, require access to the internet and depend on complex technological infrastructure.

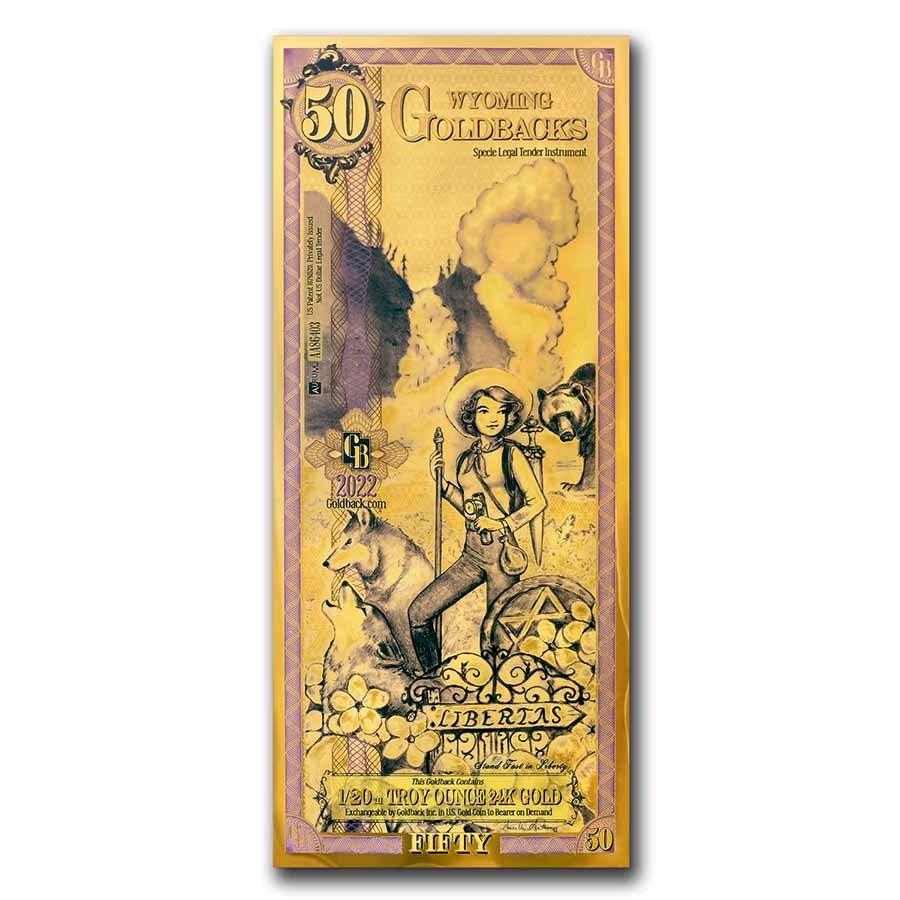

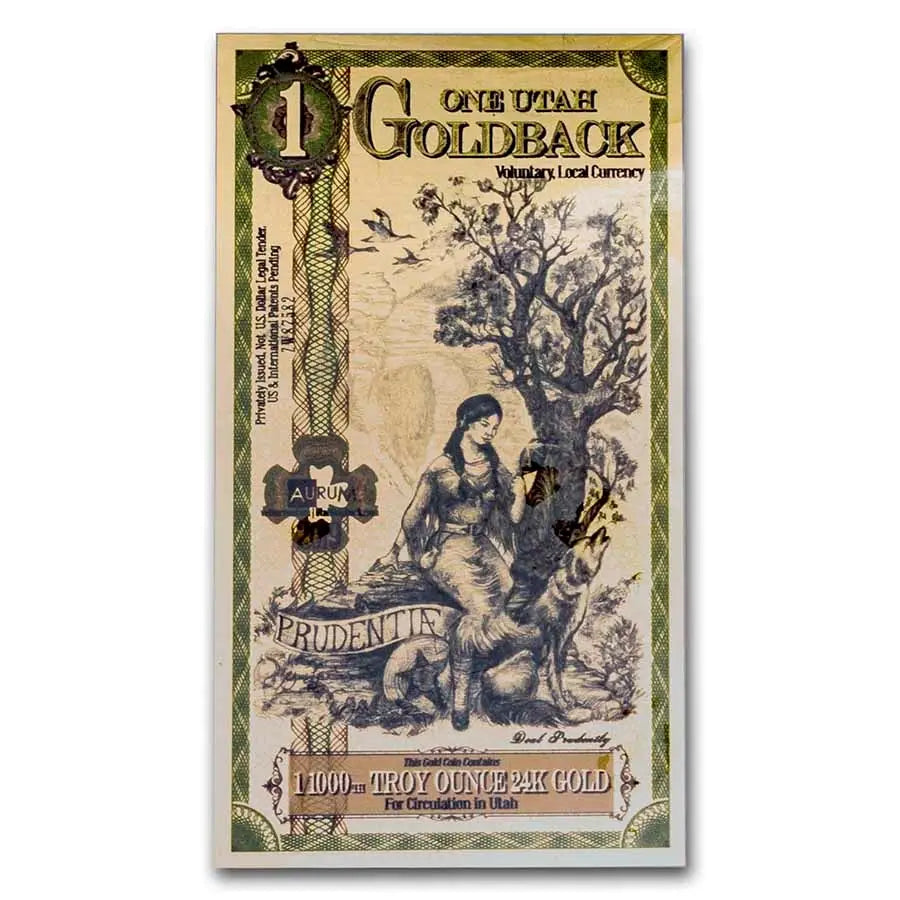

3. Immediate Usability

• Goldbacks can be used directly for transactions without needing intermediaries like exchanges or wallets. They are tangible and can be handed over physically, making them more accessible for face-to-face transactions.

• Cryptocurrencies often require understanding of digital systems, wallet setup, and sometimes long confirmation times for transactions.

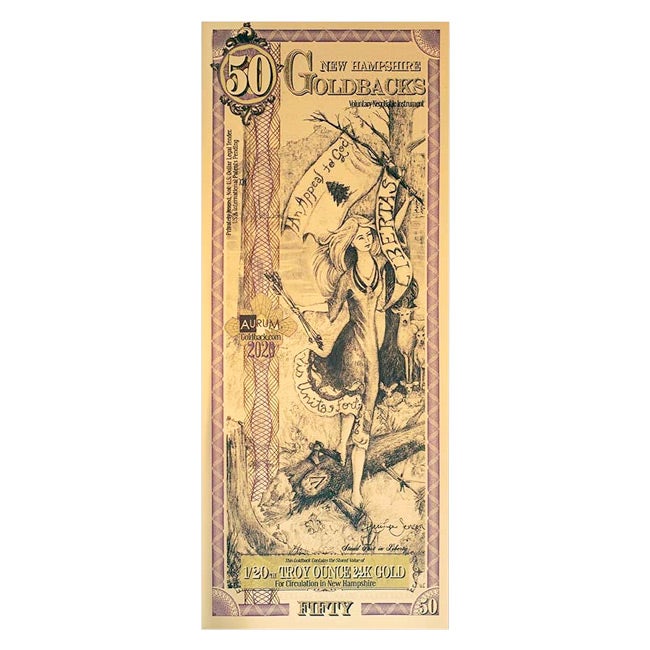

4. Security Against Hacking

• Physical Goldbacks cannot be hacked or digitally stolen. They are as secure as the physical environment in which they are stored.

• Cryptocurrencies, despite strong encryption, can be vulnerable to cyber theft, hacking, and loss of private keys.

5. Stability and Trust

• Gold has a long history as a stable store of value, making Goldbacks inherently trustworthy. Their physical form reassures users of their worth.

• Cryptocurrencies are highly volatile, with values fluctuating dramatically based on market sentiment, regulatory news, or technological changes.

6. Tangible Wealth

• Holding Goldbacks provides a sense of physical ownership and wealth, which can be psychologically comforting. People can see and touch their assets.

• Cryptocurrencies are entirely virtual, which may feel less real to some individuals, especially those unfamiliar with digital assets.

7. No Counterparty Risk

• Goldbacks are self-contained; their value is not reliant on any third party, such as a bank or exchange.

• Cryptocurrencies depend on blockchain networks and exchanges for trading, which introduces potential risks, such as exchange failures or regulatory crackdowns.

Summary

The tangibility of Goldbacks appeals to those who value physical, stable, and universally recognized assets. While cryptocurrencies offer advantages like ease of global transfer and programmability, Goldbacks’ intrinsic value, independence from technology, and security make them a compelling alternative, particularly for people seeking a reliable, physical form of currency.